Partners of 3one particular4 Funds, a venture capital agency in India, recently went on a street present to raise a new fund. Inside two and a 50 % months, at the height of the worsening worldwide financial state, they experienced secured $200 million. It is the fourth marquee fund for the Bengaluru-headquartered fund, whose portfolio involves four unicorn startups.

The fund, sixth over-all for 3a single4 Capital, was oversubscribed to $250 million but the firm is accepting only $200 million to hold itself lean and disciplined, reported Pranav Pai, co-founder and companion at 3just one4 Funds. The firm’s conclusion to limit the fund dimensions is emblematic of its strategic choices, which have set it apart from other Indian enterprise corporations.

“We are recognised to give fantastic returns. Our general performance has been benchmarked amid the most effective major performing resources in the place. So we questioned ourselves the tough inquiries, can we continue our efficiency with a bigger fund dimensions? Do we even require that a lot capital for the early-phase?” claimed Pai in an interview with TechCrunch.

In recent decades, a surge of undertaking capital companies in India have lifted unprecedentedly big money, sparking problems about the dependable allocation of this capital, notably for early-phase startups. Critics dilemma regardless of whether there are sufficient feasible corporations in the Indian market place to absorb and properly employ these major investments.

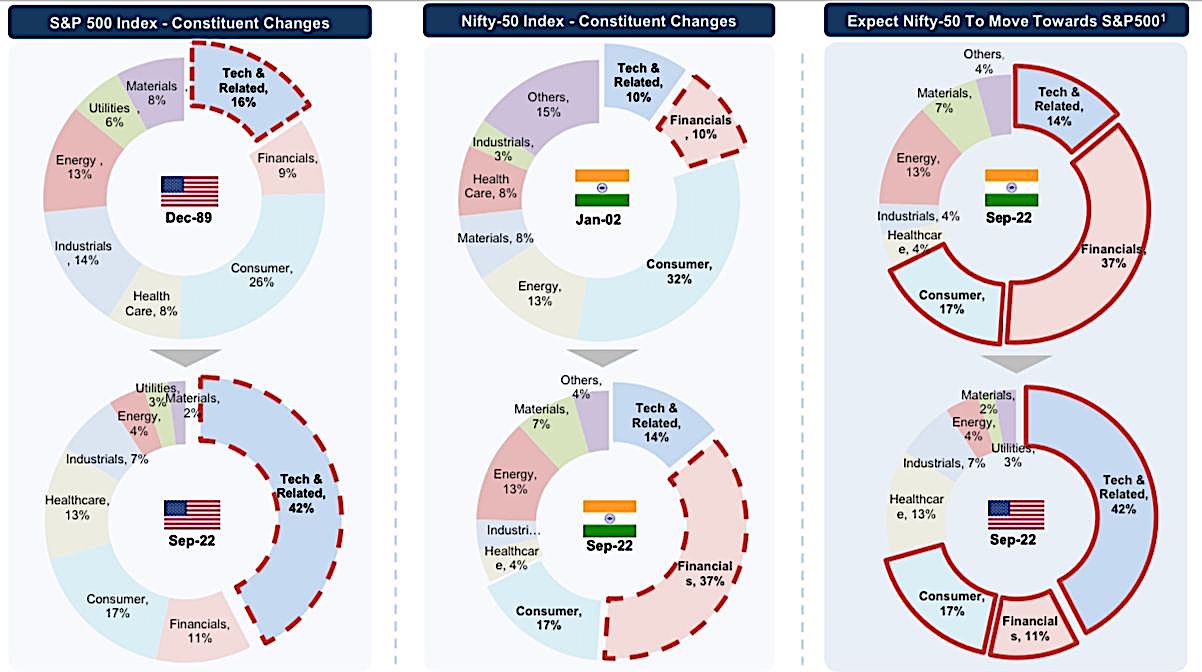

Pai, pictured above, asserts that there is ample area for much more Indian organizations to pursue IPOs, as the nation’s IPO market has verified thriving and well-regulated for institutional investors. He anticipates a transformation in India’s inventory index, with an escalating variety of tech organizations, applications, providers, fintech, and payment remedies turning out to be portion of the index.

A glimpse at how S&P 500 Index and Nifty 50 Index have evolved around the many years and projections for long run. (Impression and assessment by Mirae Asset)

Even with this, Pai acknowledges that the Indian marketplace has nonetheless to entirely recognize its opportunity for mergers and acquisitions. While there has been growth in M&A activity—increasing three to four moments in the earlier 5 years—it remains under anticipations. For the Indian industry to prosper, Pai emphasizes the have to have for a more robust M&A landscape.

In excess of the very last half-10 years, several Indian venture corporations have shifted their attention to early-phase investments. In spite of this elevated aim, the marketplace proceeds to rely on international buyers to help mid- and progress-stage promotions, highlighting the require for further more expansion in India’s undertaking cash ecosystem. “We have high undertaking mutual money and PEs. We hope that more of these corporations will start dedicated cash for Indian startups,” he said.

Half of the money in the new fund for 3one4 has appear from Indian investors, a different element that differentiates the company from several of its peers. All the systemically important Indian financial institutions, and the top five community banks by market cap in general have invested in the new fund. Eight of the best 10 mutual fund operators are also LPs in the new fund, reported Pai. “We are also happy to have foremost world wide endowments, sovereigns and insurance coverage organizations as LPs,” he claimed.

“We want to be India’s major homegrown venture funds organization. We are based here, we commit in this article – we really don’t want to invest in Southeast Asia – and our fund measurement and approach are aligned with possibilities in India. As our corporations have IPO-ed above the years, we have noticed the value of having India’s premier institutions working with us to enable make these corporations. It would be hard if we didn’t have banks to assistance our firms from every thing from profits assortment to payrolls. And mutual resources are prospective buyers, guide runners and sector makers for IPOs and them getting the inventory presents a vote of self-confidence to the market place,” he said.

314, which focuses mainly on early-phase and in sectors including direct-to-purchaser tech, media and articles, fintech, deep know-how and SaaS and enterprise automation, now manages about $750 million in AUM and its portfolio includes HR platform Darwinbox, enterprise-to-company centered neobank Open, client-concentrated neobank Jupiter, Licious, a immediate-to-purchaser brand name that sells meat, community social networks Koo and Lokal, amusement service Kuku FM, fintech Increase Monetary, and gaming firm Loco.

3just one4 Funds has obtained a reputation for its contrarian investment decision strategy, as exemplified by its early financial investment in Licious. Around five years in the past, the prevailing opinion held that India’s selling price-delicate market place would not pay back a high quality for on line meat supply. However, Licious has due to the fact developed into a single of South Asia’s major immediate-to-consumer models, with a existence in roughly two dozen metropolitan areas across India.

An additional instance of 3just one4’s daring investments is Darwinbox, a bet made at a time when most traders doubted the ability of Indian SaaS providers to increase internationally or garner ample local business enterprise subscriptions.

3one particular4 Capital’s contrarian tactic extends to the investments it has intentionally prevented as very well. In 2021, amidst a frenzy of expense action in the crypto room, virtually every single fund in India sought chances and backed crypto startups. Nevertheless, 3just one4 Money, immediately after extensive evaluation of the sector, selected not to make any investments in crypto.

The company, which employs 28 people today, is also concentrating on setting new specifications in transparency and governance for alone. It is the very first VC to be a signatory to UN PRI, it stated. “We have to report, behave, act and look a specific way. We have to glimpse like the fiduciary of greatest establishments in the globe, and then and only then we top quality to convey to our portfolio founders that this is how we want to create ideal in class corporations with you,” mentioned Pai.