Posted: 2/8/2023 | February 8th, 2023

Due to the fact coming out in 2021, the Bilt Rewards Mastercard has been an complete video game-changer for renters that love to vacation. It is the only credit history card that lets you to get paid factors on your month to month hire payment — up to 50,000 points for each calendar year, (which could pay back for a spherical-trip flight to Hawaii, for example).

You can use these points like any other journey benefits details (these kinds of as those from Chase, American Categorical, or Funds One), transferring them to airline or hotel partners or shelling out for travel instantly by a specific portal.

But though the details-for-hire perk gets all the awareness (and rightfully so), the Bilt Benefits Mastercard is a lot more than a just one-trick pony.

To actually get the most out of this important card (a single that I feel every renter must have in their wallet), listed here are some critical issues to know about the Bilt Mastercard:

1. There is no once-a-year fee

One of the most significant items to think about when opening a new credit history card is regardless of whether there is an annual rate, and if so, no matter if shelling out it can make feeling in accordance to your investing patterns and ambitions.

Most of the very best travel credit score cards have yearly expenses, and for frequent tourists, they’re ordinarily really worth it. You can get a great deal far more price out of a card than its annual payment if you’re an avid flier who enjoys lounge entry, priority boarding, checking more baggage, or other prevalent benefits.

But you don’t have to be concerned about that with Bilt, as the card currently has no rate. You can get paid details on your rent entirely for free of charge!

2. There is also no welcome present

On the other hand, the flip side of there being no annual cost is that there is also no welcome give on the Bilt Rewards Mastercard.

Welcome gives (also known as indicator-up bonuses) are the factors you receive by paying a specific amount of money inside a specified time frame just after opening a credit rating card. For illustration, you may well be equipped to earn 60,000 points if you expend $3,000 USD in just the 1st three months of opening a individual card.

These gives soar-commence your points “fund” and can normally sum to a free of charge round-excursion flight correct off the bat. Welcome provides are so essential to any superior travel hacking tactic that I normally advise towards signing up for a card except if there is a sizable 1. The point that I wholeheartedly advise the Bilt card, even with out a welcome supply, ought to demonstrate you just how wonderful I consider this card is.

3. There is a bare minimum transaction need to make factors

After opening the Bilt Mastercard, maybe the most critical thing to know is that you must make a minimum amount of five transactions just about every statement period of time to gain points. That goes for all points, which includes the factors you are going to get for paying your lease.

That signifies if you really do not make five purchases on your card that time period, you will not make any factors at all — even if you have paid out hire by way of Bilt.

The good news is that there’s no bare minimum obtain prerequisite, only a bare minimum transaction prerequisite. As lengthy as you make five buys — of any dimension — on your Bilt card each and every thirty day period, you are going to get your details.

4. You can receive factors on much more than just rent

Whilst earning details on rent is the principal marketing point, the card offers extra means to generate details also:

- 2x factors on vacation

- 3x factors on dining

- 1x points on all other purchases

(These earning classes are the exact same as admirer-most loved Chase Sapphire Preferred, for which there’s an annual cost of $95 USD).

So, for case in point, if you use your Bilt card all through the thirty day period on journey or dining buys, you will not only get 2-3 instances the factors, but you’ll also hit your minimum 5-invest in need.

5. You can max out on factors gained for lease

It is also really worth using your card for buys other than rent for the reason that of the fact that you can max out on the variety of points attained for hire (details for hire are capped at 50,000 for every year). Immediately after that, you won’t receive any much more details on rent for that year.

On the other hand, taking into consideration you make at a rate of 1 Bilt place for every $1 used on lease, you will only reach the limit if you expend above $4,166/thirty day period in hire. If your rental payment is beneath that, you don’t have to get worried about hitting the restrict.

6. You can make even additional points on hire working day

On the initially day of the month, your details earning energy is doubled, meaning that you’ll get paid 6x factors on eating, 4x points on travel, and 2x on other buys (other than lease) manufactured on the initially of the thirty day period.

If you get into the routine of applying your Bilt card for every thing you acquire on the very first day of the thirty day period, you’ll now be that considerably closer to hitting your five minimum amount transactions, all when receiving even extra details for your purchases.

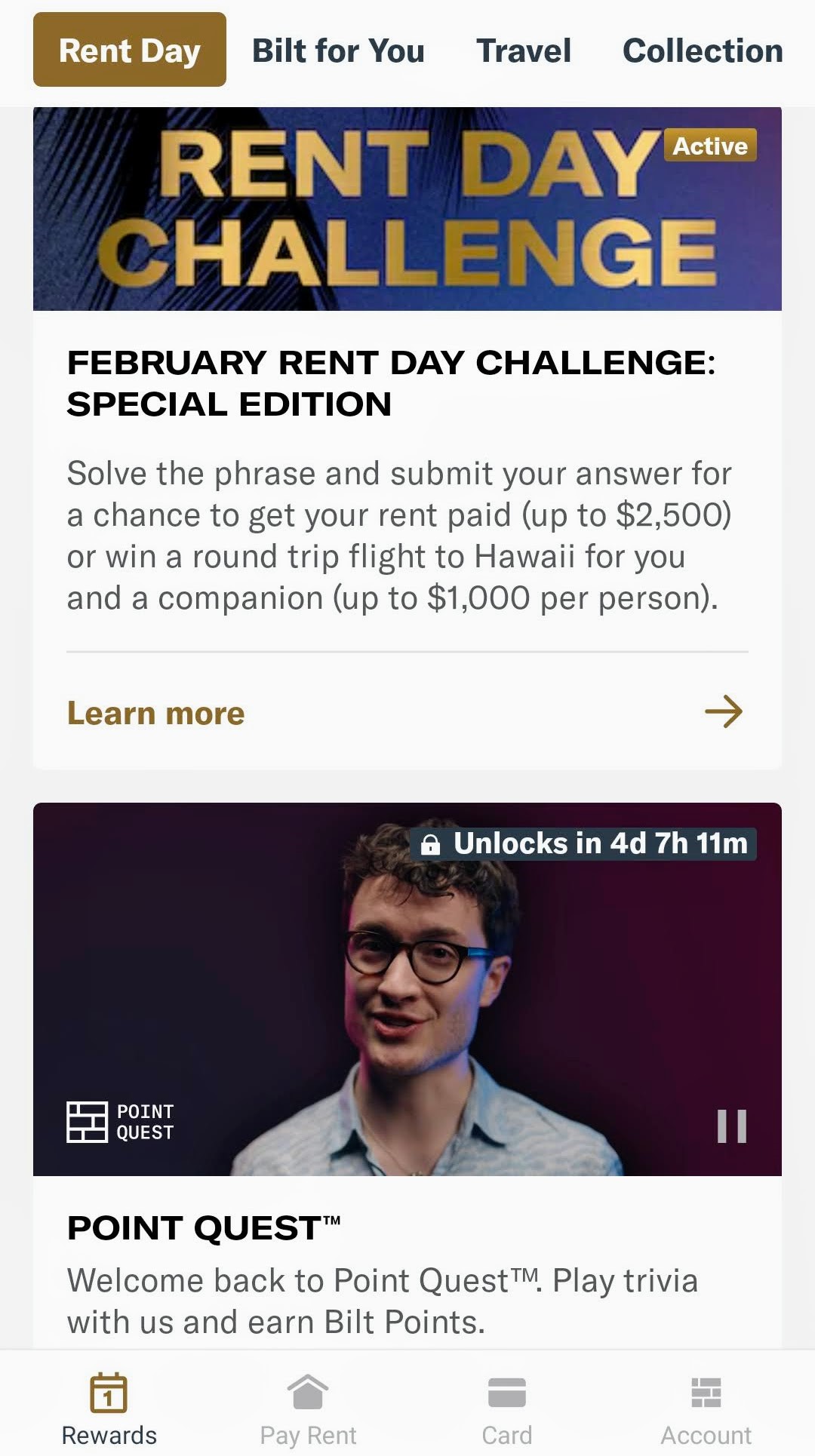

And when no a person wants more apps on their phones, you will want to down load the Bilt app for prospects to generate even extra points. Every single hire day, there are new techniques to easily earn points in the app. These adjust every single month, but in the earlier have provided participating in Issue Quest, in which you get paid factors for appropriate answers to trivia issues.

There’s also the Lease Working day Obstacle, in which you can enter to get a totally free month’s hire by effectively finishing a fill-in-the-blank phrase throughout the day.

When some of these options do not give lots of points, they get extremely very little time to complete, and they all add up!

7. Bilt points = American Airways details

Yet another explanation to amass points is simply because Bilt has American Airlines as a transfer companion — and it’s the only card that does. Considering the fact that no other card offers details that transfer to American, Bilt is the only way to get AA details without acquiring an AA card.

This is fantastic news for American Airways loyalists or tourists with unique journeys in intellect for which they want to use AA points. For instance, I’m presently prioritizing my Bilt card alternatively of my Chase Sapphire, since I want these AA factors for a excursion I’m arranging to Japan this yr (AA is a husband or wife with Japan Airlines).

In addition to American Airlines, you can transfer your Bilt details on a 1:1 foundation to quite a few other journey associates, like:

- Air Canada

- Air France

- Cathay Pacific

- Emirates

- Hawaiian Airways

- Hyatt

- IHG

- Turkish Airlines

- United

- Virgin Atlantic

You can also redeem points for exercise classes, like SoulCycle, Solidcore, Rumble, and Y7, and for goods in the Bilt Collection, a curated choice of artisan home décor objects. Nevertheless, I’d suggest towards this, as redeeming points for conditioning courses comes out to about 1 point per cent — and you can get a substantially improved redemption on travel buys.

8. Bilt provides excellent journey defense

Past its details-earning abilities, Bilt gives strong journey security, especially for a no-price card. Just maintain in brain that you must guide travel working with the Bilt card in purchase to get these positive aspects. The protections are similar to that of other “starter” journey credit history playing cards, like the Chase Sapphire Desired.

Right here are the travel protections that Bilt currently gives:

- Excursion cancellation safety and interruption protection

- Trip delay reimbursement (for delays of six hours or much more)

- Car rental collision coverage

- Mobile cellular phone protection (up to $800 USD)

- No international transaction service fees

Click on in this article for a total breakdown of benefits and advantages and charges and fees.

Even though these protections — like that of any card — are not a substitute for travel insurance (which you should constantly get!), they’re wonderful perks, and you get them at no added expense.

All in all, acquiring the Bilt card is a no-brainer for everyone who pays hire in the US, as it’s currently the only way to receive points for free on this required month-to-month expense.

But, though it is worthy of getting for just that profit by yourself, the Bilt card presents a good deal of other great capabilities that make it even much more precious. The skill to transfer to American Airlines, double details on Rent Working day, new methods to receive additional factors, and a nicely-rounded roster of travel rewards and protections make the Bilt card more than deserving of place in your wallet. It is come to be just one of my beloved cards and I obtain myself achieving for it a ton!

Want to understand all about factors and miles?

Quit paying whole cost for airfare! Down load our cost-free guideline to vacation hacking and study:

Quit paying whole cost for airfare! Down load our cost-free guideline to vacation hacking and study:

- How to choose a credit score card

- How to receive miles for cost-free flights & accommodations

- Is journey hacking really a fraud?

Click on Here GET THE No cost Guidebook Sent TO YOU

Guide Your Excursion: Logistical Guidelines and Methods

Reserve Your Flight

Discover a cheap flight by utilizing Skyscanner. It is my favorite lookup motor due to the fact it queries websites and airways about the globe so you generally know no stone is currently being still left unturned.

Ebook Your Accommodation

You can reserve your hostel with Hostelworld. If you want to keep someplace other than a hostel, use Reserving.com as it continuously returns the least expensive costs for guesthouses and hotels.

Do not Forget Journey Coverage

Vacation insurance plan will defend you versus illness, personal injury, theft, and cancellations. It’s extensive safety in situation anything goes completely wrong. I never go on a journey with out it as I have had to use it lots of periods in the past. My favorite businesses that supply the greatest service and price are:

Want to travel for totally free?

Travel credit rating cards make it possible for you to gain points that can be redeemed for no cost flights and accommodation. They are what maintain me touring so much for so minimal. Test out my information to selecting the proper card and my current favorites to get started and see the most recent ideal bargains.

Ready to Ebook Your Trip?

Check out my source web page for the very best companies to use when you vacation. I checklist all the kinds I use when I vacation. They are the finest in class and you just can’t go completely wrong working with them on your vacation.