A critical resource of affordable housing inventory was cut in 50 percent in excess of the very last 3 decades, ensuing from effectively-meant but significant-handed endeavours to preserve delinquent borrowers in houses.

That key supply of very affordable housing stock: distressed houses offered to 3rd-celebration consumers or repossessed by loan companies at foreclosure auction. After the transfer of ownership occurs at foreclosure auction, a distressed home can be renovated and returned to the retail sector as affordable housing for homeowners or renters.

“[I am] renovating residences at a realistic price tag so that individuals in our local community can ideally have fantastic high-quality, reasonably priced housing to order,” mentioned Pam Franklin, a Kansas-dependent Auction.com consumer who buys just one to two distressed attributes a calendar year and resells them to owner-occupants following renovation. “[My renovated homes are] minimizing the quantity of rental qualities, which in our city has develop into a resource of demise.”

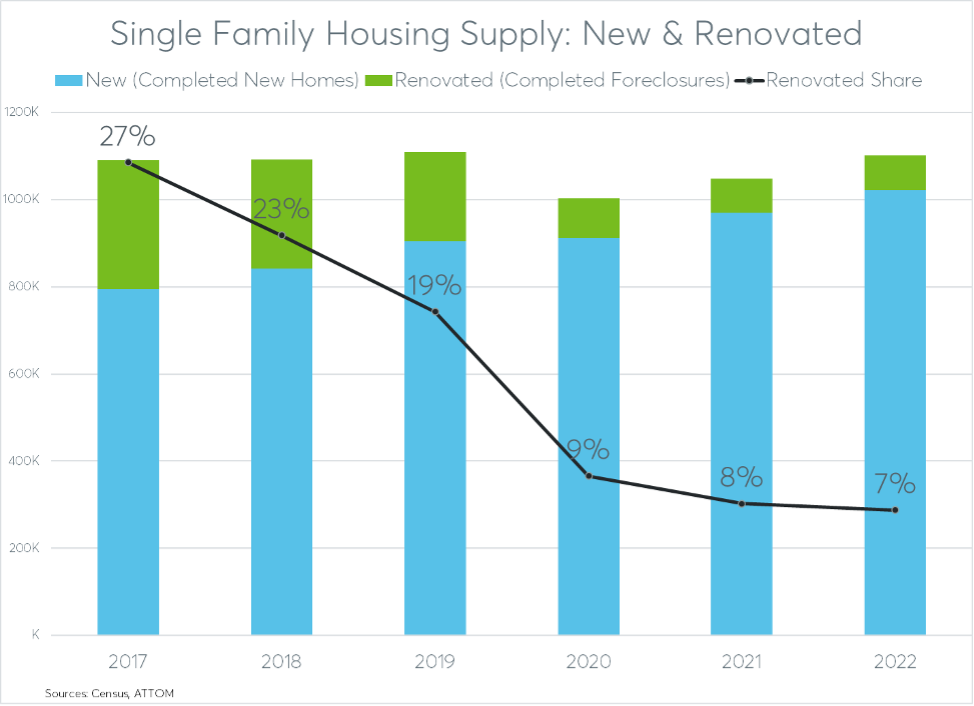

In the 3 many years prior to the pandemic, concluded foreclosures auctions represented a opportunity cost-effective housing supply of 250,000 houses a calendar year on normal, in accordance to general public file details from ATTOM. In 2019 the variety was 200,000. When which includes the close to 900,000 one spouse and children homes manufactured by new homebuilders in the course of the 12 months, according to info from the Census and U.S. Department of Housing and City Growth (HUD), that 200,000 represented close to 20% of all single-family members properties supplied to the marketplace in 2019.

Far more Economical than New Residences

Not incredibly, housing supplied by new homebuilders is bigger priced than housing supplied by distressed house renovators. New one-loved ones residences sold for an ordinary selling price of additional than $377,000 in 2019. By comparison, renovated foreclosures that marketed in 2019 had an regular gross sales cost of $244,000 — $133,000 (35%) decreased than the common rate of new residences.

Economical for Area People

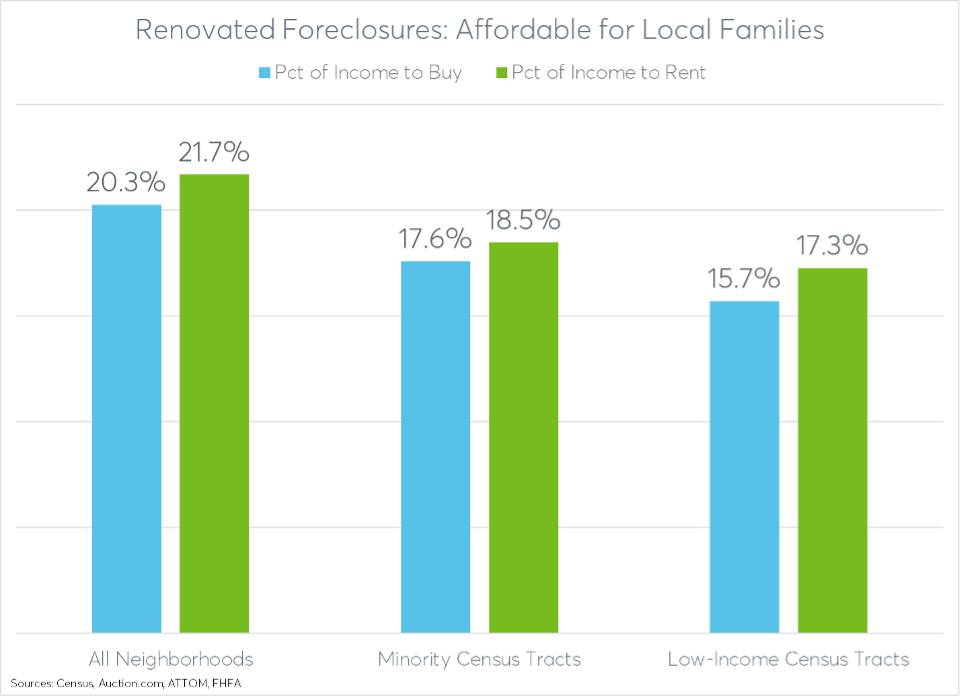

Renovated foreclosures aren’t just economical relative to the all round retail market. They are economical for community families making the median cash flow in the surrounding neighborhood.

The month-to-month home payment to acquire a renovated foreclosures — assuming a 5% down payment, the heading 30-12 months preset house loan rate at the time of sale and such as residence taxes and insurance coverage — represented just 20% of the median household cash flow in the encompassing Census tract. Which is in accordance to an evaluation of far more than 275,000 properties brought to foreclosure auction on Auction.com in the previous 7 years, between 2016 and 2022.

“I shell out the closing charges for veterans, very first responders and educators to assist extend homeownership amongst these teams,” stated George Russell, a Texas-dependent Auction.com customer.

A tiny more than 50 percent of renovated foreclosures conclude up as owner-occupied houses. The remainder present a wholesome supply of reasonably priced rentals. The evaluation of 275,000 houses brought to auction above the final seven yrs demonstrates these held as rentals had an believed lease that represented 22% of the median loved ones cash flow in the encompassing Census tract.

“I am delivering harmless and economical housing in markets that have limitations of these offerings,” explained Tiffany Bolen, a Ga-centered Auction.com consumer who mentioned her principal investing technique is renovating and holding qualities as rentals. Bolen mentioned that she gives changeover support to aid latest occupants of distressed qualities exit gracefully.

The affordability of renovated foreclosures extended into underserved neighborhoods as outlined by the Federal Housing Finance Agency. Purchasing a renovated foreclosure essential 16% of the median family money in low-income Census tracts and 18% of the median earnings in minority Census tracts. Leasing a renovated foreclosures needed 17% of the median family members earnings in minority Census tracts and 19% in minority Census tracts.

“I purchase properties in transitional neighborhoods. Then I renovate qualities from the outside to the within,” mentioned James Barber, a Birmingham, Alabama-primarily based Auction.com consumer who stated his common renovation price range is in between $20,000 and $50,000. “This delivers contemporary-experience homes to primarily more recent owners. This also raises the houses and neighborhoods values. … Currently I am investing 30k of my own money into a dwelling I procured on Auction.com. I will then provide it to a initial-time homebuyer.”

Cost-effective Supply Disruption

But this essential source of reasonably priced housing was reduce in fifty percent, if not extra, around the previous three decades. Experienced foreclosure quantity continued at the exact speed as 2019, an further provide of about 600,000 reasonably priced properties would have been manufactured among 2020 and 2022. As a substitute, 250,000 accomplished foreclosure auctions — considerably less than half of the predicted quantity — basically transpired through that timeframe, in accordance to ATTOM knowledge.

This sharp reduction in foreclosures auction volume was mainly the result of effectively-intended and aggressive foreclosure avoidance endeavours enacted in the wake of the COVID-19 pandemic declaration in March 2020. A nationwide foreclosure moratorium on governing administration-backed mortgages took result in April 2020 and lasted by August of 2021. A nationwide home loan forbearance software was legislated into truth by Congress via the CARES Act, also in April 2020.

Though the foreclosures moratorium expired extra than a year back and the forbearance system is winding down — slated to conclude in May 2023 along with the stop of the national unexpected emergency triggered by the pandemic — foreclosures auction quantity has been slow to return to pre-pandemic concentrations. Facts from the Auction.com system, which accounts for close to 50 % of all U.S. foreclosure auctions, displays volume at just 60% of pre-pandemic (Q1 2020) levels in the initial quarter of 2023.

The slow-to-return foreclosures volume is probable the final result of a regulatory atmosphere in which mortgage loan servicers are fearful of shifting forward with foreclosures — particularly if there is a probability that a delinquent borrower has any fairness in the residence.

“My most significant panic is the total of fairness [that delinquent borrowers may have],” explained a agent from just one countrywide home finance loan servicer throughout a panel at the Five Star Government Forum in Washington, D.C., in April. “[We] really don’t want to foreclose on people with fairness … [but] folks really don’t know they have equity or put their head in the sand.”

The gradual return of foreclosure quantity has resulted in a growing backlog of pandemic-deferred distress. This backlog is comprised of delinquent home loans that have fatigued all foreclosure avoidance initiatives but continue on to languish in pre-foreclosures limbo.

Far more than fifty percent a million home loans (520,000) had exited forbearance and have been however delinquent with no decline mitigation program in area as of February 2023, in accordance to the Black Knight Home loan Keep an eye on. That was an improve of 174,000 (50%) from a 12 months back.

“Who’s likely to be the initially one to open up the floodgates?,” requested Monthly bill Bymel, founder and CEO of Very first Lien Capital, at a default sector meeting in March. Bymel said he knows of huge home loan servicers with tens of thousands of foreclosures currently being held back in dread of the headlines that might final result. “There’s additional skeletons in the forbearance closet than we consider.”

But even with Bymel’s dire language, opening the floodgates would likely not result in a catastrophic flood of foreclosures that would drag down the over-all housing current market. Employing historic pre-pandemic roll premiums from significantly delinquent to foreclosure, the backlog of 520,000 delinquencies would translate into about 150,000 accomplished foreclosures above the future 12 months. That would hold overall foreclosure quantity less than the 250,000-a-year typical found in between 2017 and 2019.

A 12% Improve in Source

Nevertheless, even a return to the fairly reduced pre-pandemic volume of foreclosures would make a non-trivial contribution to the nation’s cost-effective housing provide.

Supplied that 2022 foreclosures quantity was at about 40% of 2019 amounts, returning to 2019 ranges in 2023 would suggest an added 127,000 properties entering the housing marketplace source chain. That would symbolize a approximately 12% strengthen to the total provide of single-family households that have been generated by new property builders in 2022. And a disproportionately substantial share of that offer would be in the very affordable phase of the current market.

“We have a absence of housing in this area. We have a great deal of armed forces buyers right here and it’s difficult to discover them very affordable, up-to-date houses in a well timed manner,” said Julie Bridges, a New Mexico-based Auction.com purchaser. “My investing is aiding offer renovated, up to date properties to folks that would have to lease if not.”

In addition to providing very affordable housing inventory, renovated foreclosures also stand for a lot more chance for the neighborhood neighborhood developers who are acquiring and renovating the properties.

“My investing is serving to me and my family members,” claimed Kerry Wojtala, an Alabama-centered Auction.com consumer who explained she purchases and renovates a person or two properties a year. “I was a single mom for a lot of yrs … Individually, investing affords me fiscal independence with a aim of creating a strong system for my sons so they by no means have to depend on welfare or govt sources.”