Feishu, ByteDance’s office collaboration app, surpassed $100 million in annual recurring income past calendar year, Xie Xin, the chief executive of Feishu, told staff members Thursday, according to a person familiar with the issue.

In late 2021, the place of work resource became one particular of the firm’s six specific business groups, which means it was provided the same strategic significance as other BGs at ByteDance, which consist of TikTok, Douyin, Dali (the education and learning BG), BytePlus (B2B AI and facts infrastructure) and Nuverse (video clip online games).

The milestone was very first documented by the Chinese tech information site 36kr, just a couple of days right after a controversial short article by Leiphone, yet another Chinese news outlet, questioned Feishu’s cash melt away. ARR commonly actions a software company’s subscription-primarily based earnings.

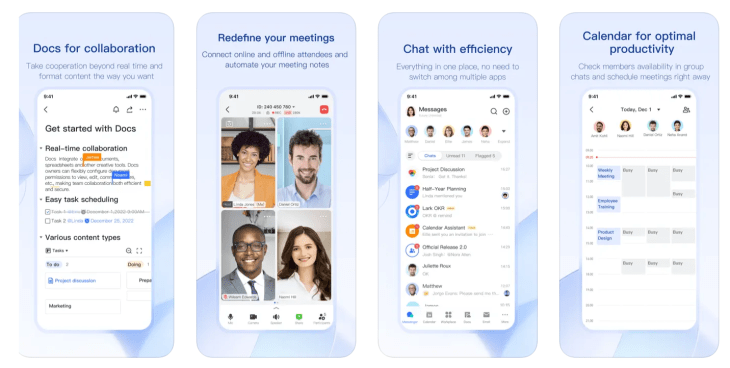

Feishu, which has an international variation termed Lark, is an all-encompassing get the job done communication messenger with handy attributes from computerized notetaking for video calls and shared calendars to collaborative paperwork. Feishu spent a lot of resources constructing these features alone, a contrast to Slack’s open up platform that integrates with a myriad of 3rd-celebration purposes.

Performing all the things in-dwelling is conducive to delivering a frictionless person practical experience, but it comes at a large charge. At its peak in 2022, Feishu experienced a headcount of 10,000 (which include outsourced workers), in accordance to the Leiphone post. The Wall Street Journal documented that Feishu now has 7,000 folks.

For comparison, Slack noted 2,545 entire-time employees and an annual earnings of $902.6 million in January 2021.

ByteDance’s significant financial commitment in Feishu is telling of the condition of enterprise software program in China. At a time when Silicon Valley traders are heralding product-led expansion — products and services that change users by means of their products and solutions, as exemplified by Calendly — computer software in China are even now largely counting on revenue, internet marketing and providers to recruit buyers.

As a handful of founders lamented to me about the a long time, the tradition of spending for SaaS has not seriously arrived in China yet, so quite a few of them are now stepping up overseas growth. On the supply side, competitors is fierce. A generative AI founder shared their problem of functioning an enterprise tech startup in China, where the return of investing in fewer experienced labor continue to trumps that of expending on tech talent:

“In the U.S., you can do rather perfectly by developing product-led software package, which does not rely on human providers to obtain or keep consumers. But in China, even if you have a wonderful product, your rival could steal your supply code overnight and seek the services of dozens of customer guidance team, which do not cost that significantly, to outrace you.”