Your social media feed correct now is possibly abuzz with statements that the FHFA’s new loan degree pricing adjustments (LLPAs) on regular home loans favor customers with bad credit rating over potential buyers with fantastic credit history.

“A 620 FICO rating receives a 1.75% rate price cut and a 740 FICO rating pays a 1% fee” reads 1 screenshot from a Fox News section building the rounds on social.

Here’s the factor: that’s not true!

We’re likely to break down the FHFA’s latest loan-amount pricing adjustments, most of which are previously in influence just after getting declared in January.

Let us start off with the essentials: The pricing grid incorporates credit rating bands that correspond with upfront service fees primarily based on the home loan solution, mortgage-to-price ratio, occupancy, etcetera. Here’s the present design.

As you can see, the grid tops off at a 740 credit history score, which means any person with a FICO score of 740 would spend the identical charge on fees as another person with a rating of 780. Beneath the latest product, risk-primarily based pricing (RBP) has been dependable. Commonly talking, the decreased the credit history rating and bigger the LTV, the increased the upfront fee to mitigate the threat.

The new design tweaks the threat-centered pricing components in significant strategies.

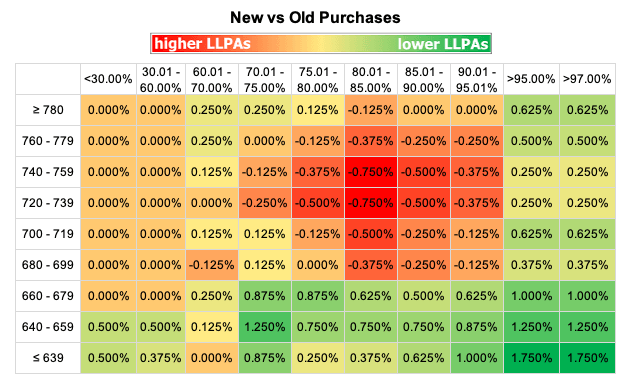

Here’s the new pricing matrix on purchase loans, which goes into influence on May possibly 1 but pretty much speaking has been in area for far more than a thirty day period. (This isn’t the grid the GSEs use, but it does exhibit where by changes are. Major props to Matthew Graham of Property finance loan Information Day-to-day for developing this shade-coded chart.)

There are new credit rating bands past the 740. You are going to also discover that the FHFA has amplified fees on bigger credit history scores and decreased LTVs. At the exact time, the FHFA has decreased fees for debtors with reduce credit history scores entire-prevent.

Let us get just one significant matter out of the way – FICO borrowers with lower scores are not obtaining better costs than bigger FICO debtors. If you have superior credit score, you are going to pay much less than an individual with even worse credit. But there are some crucial changes that total to a cross-subsidy of sorts.

*Debtors with credit history scores in between 680 and 779 with down payments concerning 10 and 20% will see a price boost of between .13% and .75%.

*On the other side, initial-time homebuyers with lower or moderate household earnings pay back no additional costs whatsoever, and borrowers who put a lot less than 5% down throughout all FICO scores will benefit.

*This chart doesn’t clearly show it, but people who will see the biggest fee boost are these in search of a funds-out refinance, where by 60% of the population analyzed by Experian would have experienced better expenses with an ordinary enhance of 55 bps.

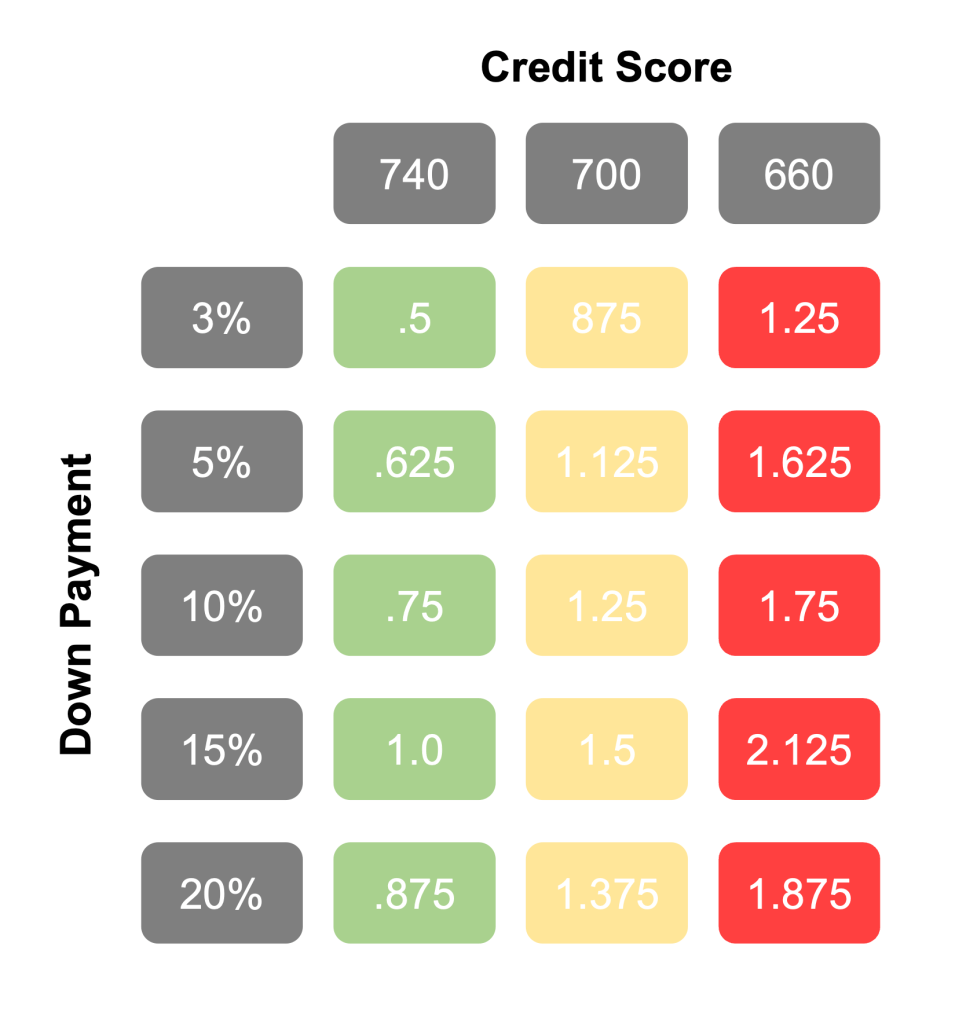

Rebecca Richardson, a financial loan officer at UMortgage, experienced a good consider on the adjustments. Let us consider a seem at her illustration, in which the profits cost of the home is $400,000 and the eventualities are credit rating scores of 740, 700 and 660, with corresponding down payments of 3%, 5%, 10%, 15% and 20%.

“People with excellent credit score are not finding penalized, nor are they subsidizing low credit score rating potential buyers,” Richardson explained in a LinkedIn write-up. “And that’s mainly since folks who have been in the downpayment cheat code zone the place they have been putting extra than 15% down but fewer than 20% experienced their conditions sponsored by cheap property finance loan insurance policies guidelines, which essentially gave them the same conditions as anyone who was placing 25% down. To me these adjustments are more about bringing matters in line in which the genuine hazard is dependent off of downpayment.”

ALRIGHT, BUT WHY IS THE FHFA Accomplishing THIS?

This pricing adjust is in line with the Biden administration’s mentioned mission to offer housing funding prospects to to start with-time homebuyers with lower credit history scores and those in underserved communities.

There ended up normally going to be winners and losers when the FHFA made a decision to modify the pricing matrix. In this situation, a part of great-but-not-outstanding credit debtors will receive a bit of a shock, a couple thousand pounds value in some cases.

I believe the FHFA is creating a calculation that better-credit history debtors will nonetheless buy the dwelling regardless of an maximize in upfront costs and have sufficient pores and skin in the match that hazard is not superior. At the similar time, a few thousand dollars could be the difference in between a consumer with a decreased credit score rating attaining homeownership or not.

Really should this coverage alter come at the price of those who are “doing things the proper way,” as James Duncan, director of advertising at Prosper Home loan, put it? It’s a truthful issue. This is a significant transform for the sector and environment a precedent on shifting away from a pure risk-based mostly design is…a hazard for the FHFA (even if the agency disagrees with that interpretation).

Everyone acknowledges that the GSEs want to be improved capitalized, but this plan would appear to be to hurt middle-course debtors and purpose to profit these who are a lot more possible to be in the FHA category. We’ll know fairly soon if this is a coverage failure.

What do you imagine about it? Share your ideas with me and the strategies you’re employing to aid prospective buyers make the ideal selection for their individual circumstance.

DataDigest is a publication in which HW Media Running Editor James Kleimann breaks down the major tales in housing by way of a details lens. Indicator up in this article! Have a matter in intellect? E-mail him at [email protected]