When FEMA produced its Chance Rating 2. methodology in Oct 2021, thousands of home owners in reduced-elevation coastal places of the United States braced for federal flood insurance hikes.

Not too long ago released information from the company displays that yearly flood insurance rates will at some point double or even triple for homeowners in some U.S. zip codes, however most property owners with flood insurance in The united states will pay out much less than they at this time do.

Congress has capped once-a-year hikes at 18%, so it will get at the very least five several years for influenced owners to strike the full fee. But for the earlier year, FEMA has necessary new guidelines to be rated less than the Risk Score 2. methodology, this means prospective buyers pay complete cost straight away.

The knowledge exhibits that the hardest strike owners are predominantly in South Florida, though some zip codes in Louisiana, Kentucky, Ohio and Texas will see double or triple digit raises as very well.

In Palm Beach County’s Jupiter Inlet, flood insurance policies will increase by an average of 342% to $3,449, according to the Miami Herald, which analyzed the FEMA information. That’s the maximum rate increase in the state.

In breathtaking Crucial Biscayne, owners will see charges climb as superior as $7,096 each year on regular, up 107% from the present $3,423 normal charge of flood insurance plan. In Miami-Dade, three zip codes will see typical quality hikes north of 200%, with rates mounting by more than $1,500 for home owners. The regular flood insurance high quality will ultimately be more than $7,000 a yr in Miami-Dade.

Householders in Gretna, Louisiana, just exterior of hurricane-vulnerable New Orleans, will see once-a-year flood coverage premiums bounce to $3,023 a 12 months from $1,139, in accordance to FEMA. In Houma, the typical top quality will increase to $3,511 a 12 months from $982.

In simple fact, most zip codes in the Southeast beneath Threat Rating 2. will see an maximize in annual premiums, in accordance to the Miami Herald’s evaluation.

A lot more than any area, the Southeast has benefited from altering migratory designs brought on by the COVID-19 pandemic. Florida’s state population grew by 706,597 persons since the 2020 Census, and the Miami-Dade metro in distinct has boomed. Florida metro places are amid the swiftest-appreciating U.S. housing marketplaces, recording some of the optimum calendar year-about-calendar year advancement in March, as calculated by the CoreLogic Household Cost Index.

The Miami metro seasoned nearly five moments the U.S. residence value appreciation rate, submitting a 15% annual maximize in March 2023 when compared with the national progress rate of about 3%, in accordance to CoreLogic.

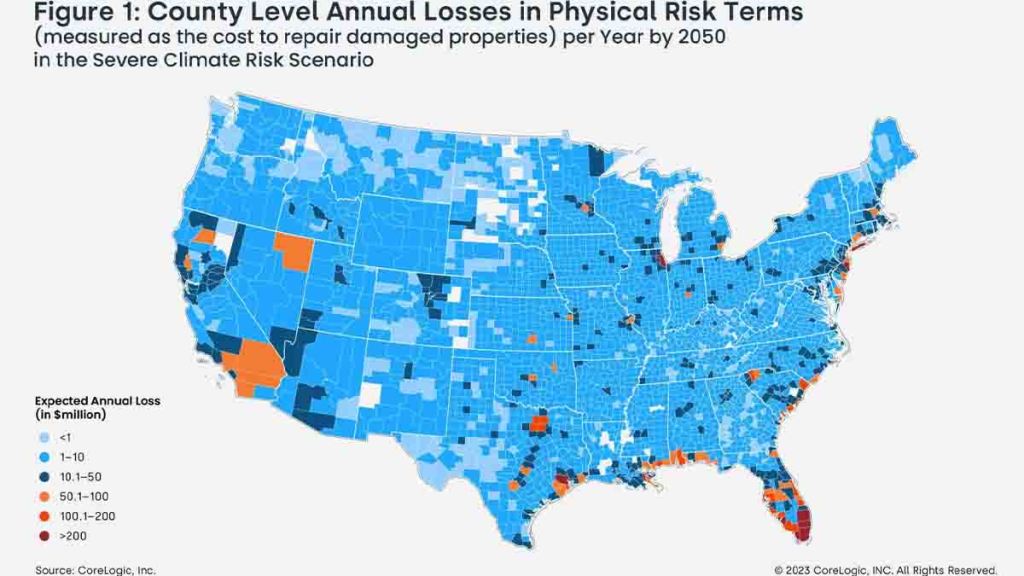

When CoreLogic ran a strain exam versus the most aggressive local weather alter eventualities, it uncovered that U.S. counties uncovered to hurricane threat have the premier believed typical once-a-year decline figures. Miami-Dade was prime of the record.

“On the recent climate change path, nationwide estimated annual losses may well increase to $23.5 billion for each year by 2050 from the foundation time period in significant local climate-chance circumstance,” economists at CoreLogic claimed.

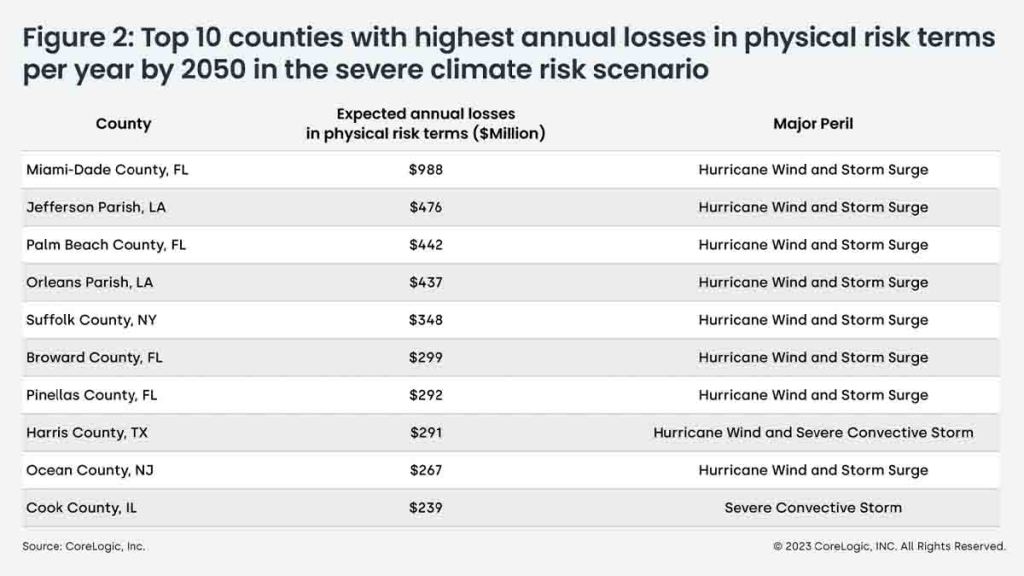

Listed here are the 10 counties with the greatest yearly decline projections by means of 2050. You’ll observe that four counties in South or Central Florida by itself account for about $2 billion in once-a-year losses.

It is no mystery that the National Flood Insurance coverage Program (NFIP) flood maps are outdated by various decades and really don’t account for tens of billions of pounds in once-a-year threat. The fees also have not been ample to go over the price of yearly flood statements – the method experienced a $20.5 billion shortfall as of 2020. The agency argues the new flood method greater accounts for bodily threat, and which is very likely legitimate, even if the true degree of hazard nonetheless isn’t shut to remaining budgeted for. Flood insurance policies charges would have to be astronomical for Miami-Dade’s real chance to be met. There is no political will to do that, not in Miami, not wherever.

In the meantime, the blend of higher flood insurance policy rates and elevated home loan prices is already cooling the housing market place in Miami a little bit. And it is not because homebuyers all of a sudden value the climate threat in a visceral way.

“I really do not assume the weather is as a lot on peoples’ radar as the cost to insure,” Christina Pappas, vice president of the Keyes Corporation, advised HW Media Editor-in-Chief Sarah Wheeler in late April. “It truly is about the threat for coverage carriers. The flip facet of that is for so lengthy, specially in the Southeast and higher-danger parts, we haven’t even had non-public firms in our market. Florida produced a state insurance policy item referred to as Citizens Insurance as a backup to individuals homes that are substantial possibility, that have been not able to get personal insurance plan. It has develop into the greatest insurance coverage provider in the state.”

The Florida legislature has manufactured major adjustments to encourage non-public insurers to re-enter the sector, which would offer a further selection outside of Citizens Coverage (which involves policyholders to have flood coverage) and FEMA’s NFIP. That is a massive move and arguably can make Florida a design for other states with related local weather-chance issues.

For householders, it does necessarily mean they are likely to pay out a large amount additional for flood insurance plan in excess of the next ten years and over and above.

“We are seeing prices for $1 million, $2 million, $3 million homes at $80,000 a year in insurance plan,” Pappas claimed. “OK, allow me set a new roof on and it goes down to $60,000…You are viewing a really massive conversation now all-around the insurance fees. Is that likely to impact affordability? Definitely.”

Are you in an region that saw a major maximize in flood insurance policy rates? How are you and your clientele dealing with it? Share your feelings with me at [email protected].

In our weekly DataDigest newsletter, HW Media Managing Editor James Kleimann breaks down the biggest tales in housing as a result of a facts lens. Sign up here! Have a subject matter in intellect? Electronic mail him at [email protected]