The greatest way to struggle inflation and get lower home finance loan charges is to get extra apartment models concluded, and so significantly, this has been slower than my tortoise Grundy. A person of the most discouraging details traces given that COVID-19 has been housing completion knowledge.

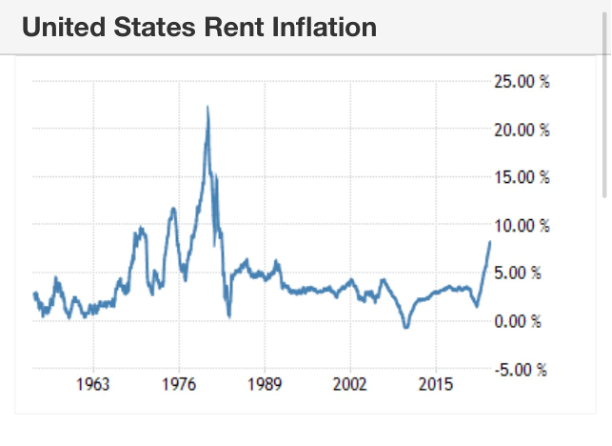

Of class, we all understood the delays during the pandemic, but all those times are about. We need to have to ramp factors up and so much, it hasn’t been stunning. The faster we get 5-unit development finished, the superior we can battle versus inflation and get lower house loan charges. Why is this the case? It is since shelter inflation is the largest component of CPI inflation at 44.4%, and you just can’t have a 1970’s inflation increase devoid of rents taking off.

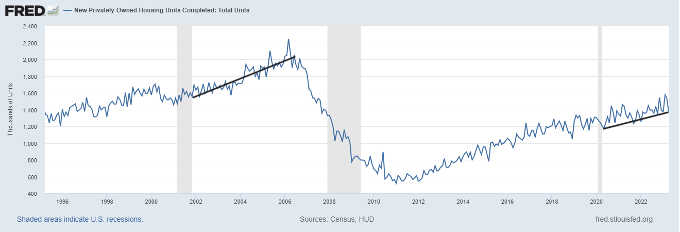

From Census: Housing Completions Privately‐owned housing completions in April had been at a seasonally adjusted yearly charge of 1,375,000. This is 10.4 per cent (±9.9 %) under the revised March estimate of 1,534,000, but is 1. percent (±16.4 %)* higher than the April 2022 amount of 1,361,000. ingle‐family housing completions in April have been at a price of 971,000 this is 6.5 percent (±11. %)* below the revised March price of 1,039,000. The April charge for units in structures with five units or more was 400,000.

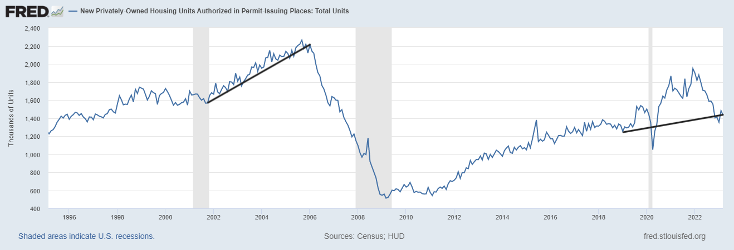

As you can see in the chart underneath, the deficiency of completion details we have had considering the fact that COVID-19 is regrettable and it is also undesirable for property finance loan premiums. Nevertheless, you can see why construction work has stayed organization. If you only saw this chart below, you wouldn’t know that housing starts off and permits had fallen.

This has been a person miscalculation people have produced when seeking for work missing in the work of construction employees, principally functioning in residential serious estate.

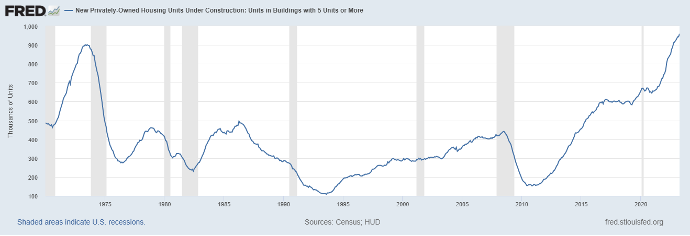

As we all know, we have a document quantity of residences under design. With rent inflation presently cooling down, retaining the strain on to battle inflation is a should for the reason that the Federal Reserve is obsessed with the 1970s inflation storyline.

I think 1970s-fashion inflation can’t take place with the development fee of hire inflation about to fade more than the following calendar year. Not only is the advancement charge of shelter inflation cooling off, much more supply is a punch in the gut versus inflation. The chart below shows why I’m skeptical about repeating the enormous rent inflation we observed in the 1970s.

So, how a lot of 5-models under development do we have nowadays? It is a file! No joke, we have more 5-models less than construction ideal now than any other time in history. This is constantly optimistic mainly because the ideal way to fight inflation is usually with source. If you check out to damage inflation with demand from customers destruction, it is only a limited-term fix.

Following the 1974 recession started off, we can see a collapse in this information, so I know we are operating on a recession time clock, but I hope we get these 5-models up as rapid as doable. We can see we have below developed residences in excess of the many years, so the significant create-up lately is significantly appreciated.

I do not believe we will be again in the 1970s, with inflation spiraling out of handle, so if the labor market place breaks, with jobless claims increasing earlier mentioned 323,000, the Fed need to have fewer fear of wild 1970s inflation. When People in america are getting rid of their employment, the Fed need to do what is required to stop even more men and women from getting rid of their work.

We are at the financial cycle stage exactly where we need to have to be additional worried about what the Fed does not do for the duration of a economic downturn given that the rate hike story is ending. Part of the difficulty is that as banking credit score receives tighter and demand will get weaker, this financial sector can get hit difficult like it did in the 1974 recession. So, get these residences up as shortly as achievable, normally we could be on the cusp of this constructive knowledge fading in the upcoming.

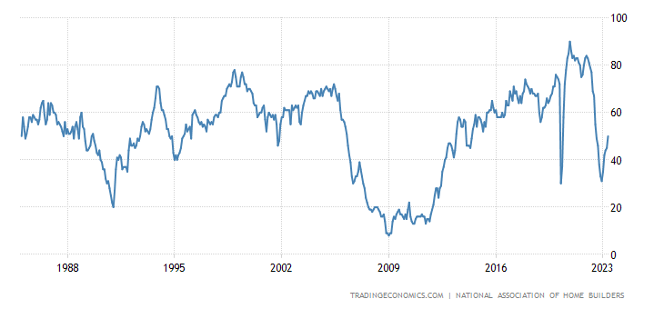

Builder’s confidence is back!

The homebuilders’ self-assurance index is back, out of damaging territory just after the waterfall collapse in the index in 2022. This index strike 50, the line amongst constructive and unfavorable. Traditionally, the housing market place has presently bottomed when the index goes from a adverse to a constructive. As the chart underneath reveals, that first bounce increased with legs is a superior indicator for the housing marketplace.

Robert Dietz, chief economist of the Countrywide Association of Homebuilders, tweeted yesterday: “May NAHB / Wells Fargo Housing Sector Index rises 5 points to vital split-even amount of 50. 5th straight month of enhance and first degree at 50 or bigger given that July 2022. Builder sentiment supported by lack of current house supply.”

Of class, the builders have taken benefit of their situation: not only are lively listings in the U.S. close to all-time lows, but builders can entice prospective buyers by providing reduce mortgage rates than what a consumer of an current dwelling can get. It’s fantastic timing taking into consideration they however having a backlog of homes to operate off.

Nevertheless, even with better confidence, the builders are not cracking out new housing permits. This can make fantastic sense to me, simply because even though they’re feeling superior about their upcoming, they even now have too considerably regular provide of properties to start off to seem out in the foreseeable future in a huge way.

From Census: Developing Permits Privately‐owned housing models authorized by building permits in April had been at a seasonally modified annual fee of 1,416,000. This is 1.5 per cent down below the revised March amount of 1,437,000 and is 21.1 p.c underneath the April 2022 fee of 1,795,000. Single‐family authorizations in April ended up at a charge of 855,000 this is 3.1 p.c earlier mentioned the revised March determine of 829,000. Authorizations of units in properties with 5 units or far more had been at a fee of 502,000 in April.

As you can see in the chart under, although the housing allow details has stabilized, it’s not lights a fireplace on foreseeable future advancement.

I have a uncomplicated model for this: as extended as the month-to-month source of properties is above 6.5 months, the builders never historically develop their permits significantly. Considering that the last new property product sales report had 7.6 months, I am not searching for just about anything significant to transpire.

We don’t have everything much too surprising in this housing commences report on the other hand, we ought to have urgency to get these apartments out as fast as achievable to battle inflation. Whilst the housing starts data, like most housing details, is discovering some stabilization at these levels, the dilemma is when will we see advancement in the knowledge strains going out? This, of training course, can be aided out with reduce home finance loan fees, and when the builders are feeling superior about their company, they are not firing out housing allow data.