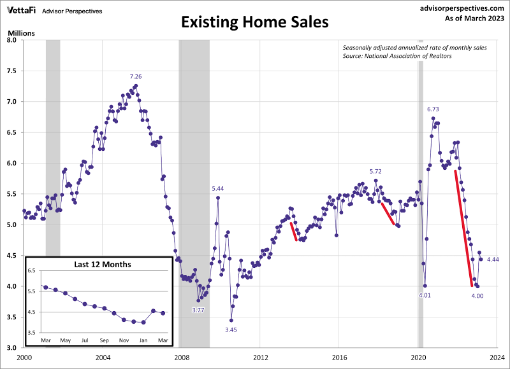

We only have 2.6 months’ really worth of housing inventory in the U.S. just after coming off the one most important property-sales crash 12 months in history. That is wherever we are nowadays in The us. As expected, current dwelling product sales fell from February to March considering the fact that the past month’s report was intensive.

We have a workable variety for 2023 revenue in the present residence gross sales current market in between 4 million and 4.6 million. If we are trending underneath 4 million — a probability with new listing facts trending at all-time lows — then we have a great deal weaker demand than persons assume. Now if we get a number of sales prints over 4.6 million, then desire is improved than the initial bounce we had before in the calendar year.

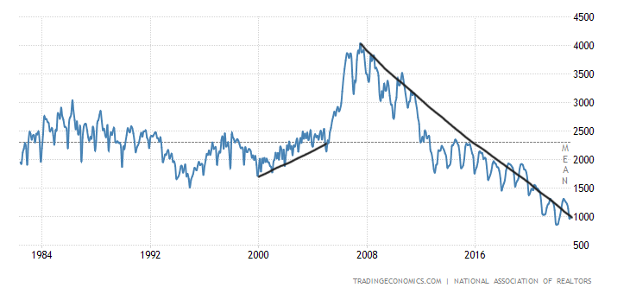

To get back to the pre-COVID-19 product sales selection, we require to see existing household revenue craze between 4.72 – 5.31 million for at least 12 months. That isn’t going on. We are working from a low bar, and as I have pressured about the decades, it’s sporadic put up-1996 to have a month to month sales development under 4 million. In the chart beneath, with the pink lines drawn, you can see how unique the income crash in 2022 was as opposed to the previous two times charges rose and profits fell.

From NAR: Total present-dwelling sales – done transactions that consist of solitary-family members homes, townhomes, condominiums, and co-ops – fell 2.4% from February to a seasonally modified once-a-year price of 4.44 million in March. 12 months-around-yr, revenue waned 22.% (down from 5.69 million in March 2022).

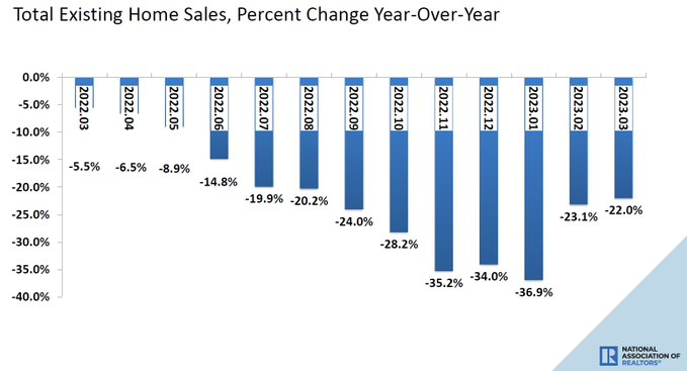

Past calendar year we had a substantial gross sales drop for the current residence product sales marketplace, which got worse as the 12 months progressed. When wanting at calendar year-more than-12 months info for the rest of the yr, we have to don’t forget that the calendar year-about-year income declines will make improvements to just mainly because the comps will get a lot easier. That will decide up speed towards the 2nd 50 percent of 2023 and we could see some beneficial year-more than-calendar year knowledge toward the finish of the yr.

NAR: Yr-about-calendar year, product sales waned 22.% (down from 5.69 million in March 2022).

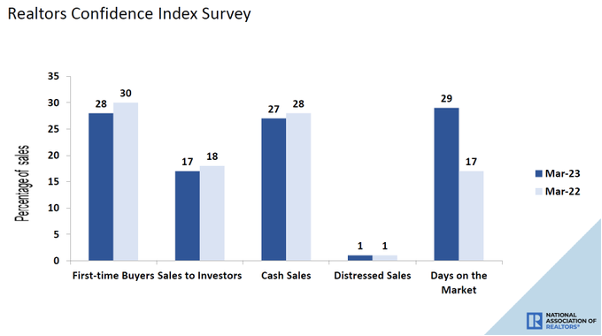

1 part I didn’t like to see in this report is that the days on marketplace fell and are back again to underneath 30 days. This is the actuality of our earth: total lively listings are continue to near all-time lows and demand so far has been secure considering that Nov. 9, 2022.

As we can see in the info down below, the days on the market place fell again down to 29 times. I am hoping that it does not go lessen than this. For some historic context, back again in 2011, this information line was 101 times.

NAR: 1st-time purchasers ended up responsible for 28% of profits in March Individual traders ordered 17% of houses All-dollars sales accounted for 27% of transactions Distressed gross sales represented 1% of sales Houses generally remained on the marketplace for 29 times.

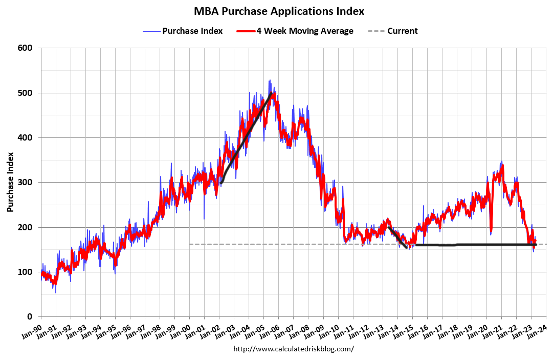

When I chat about stabilization in need considering the fact that Nov. 9, I am searching at obtain application information since that date, and — excluding some holiday weeks that I do not set any bodyweight on —we have experienced 15 good prints as opposed to 6 destructive prints in that time. So, whilst the chart underneath does not appear like what we saw in the COVID-19 restoration, it has stabilized.

I put the most body weight on this data line from the second 7 days of January to the 1st week of Might. Soon after Might, ordinarily speaking, full volumes ordinarily drop. Now, publish-2020, we have had 3 straight years of late-in-the-year operates in this facts line to mess almost everything up. Nevertheless, sticking to my previous get the job done, I have noticed eight constructive prints versus six negative prints this calendar year. So, I would not connect with this a booming demand from customers press larger, just a stabilization period of time using a minimal bar.

NAR: Whole housing inventory registered at the conclusion of March was 980,000 models, up 1.% from February and 5.4% from 1 yr back (930,000). Unsold inventory sits at a 2.6-thirty day period supply at the present gross sales pace, unchanged from February but up from 2. months in March 2022.

Overall housing stock, when up 12 months over year, is however around all-time lows, and month to month source is also up yr around 12 months. Nonetheless, as we all know, housing inventory achieved an all-time very low in 2022, so you need context when conversing about the calendar year-around-calendar year info. As we can see underneath, from 2000, whole lively housing stock rose from 2 million to 2.5 million ahead of we noticed the enormous strain spike in source from 2005 to 2007.

The NAR info seems a bit backward, so if you want much more fresh new weekly data, I produce the Housing Market Tracker each week on Sunday night to give you that info.

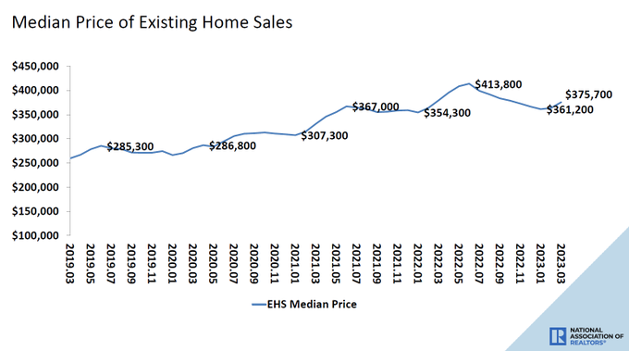

A person factor higher mortgage loan premiums have carried out for absolutely sure is that house-price growth is cooling down significantly since the major spike in costs. That development isn’t cooling as significantly as I would like, tied to my several years 2020-2024 value-development model for a secure housing current market. Nevertheless, I will consider what I can get at this level.

NAR: The median current-property selling price for all housing styles in March was $375,700, a decrease of .9% from March 2022 ($379,300). Selling price climbed slightly in a few locations but dropped in the West.

The most stunning facts we have seen in the housing marketplace due to the fact the major crash in household revenue is how very low inventory continue to is in the U.S. — except for these reading through HousingWire or listening to the HousingWire Every day podcast.

Bear in mind, inventory channels are distinct now since credit channels in the U.S. are diverse article-2010. Also, desire has stabilized given that Nov. 9, so when we discuss about housing in the U.S., let’s use the knowledge that makes feeling.

Secure need, lower housing stock, and no pressured sellers are why we created the weekly Tracker, to aim on precise information and what matters most to housing economics and the U.S. economic system.