Significant-volume property sellers are in a little bit of a pickle in today’s market place thanks to swiftly growing home finance loan costs past 12 months.

“We’re just striving to go stock rapidly,” claimed Lee Kearney, a Tampa, Florida-based actual estate trader who has an stock of among 15 and 20 properties for sale at any given time. “If it is not going, change the pricing so it does shift. These are market place-dependent conclusions.”

Kearney’s very simple tactic for surviving as a substantial-volume seller in an ecosystem wherever desire has dried up: hear to the industry and do what it says.

“As a vendor if a little something is sitting down out there a couple weeks and it’s not marketing, the cost is way too high,” explained Kearney, who has been investing by many serious estate cycles and believes housing will not be rebounding significantly in the around phrase. “There’s no fantastic news all around the corner. If you believe that that statement, then the action item is to decrease the price tag.”

Whilst there have been some latest optimistic signs in the housing and positions markets, all those signals issue to stubbornly large inflation and a corresponding stubbornness on the portion of the Federal Reserve to go on raising fascination premiums over the extended term to struggle inflation. A for a longer time-phrase fight in opposition to inflation lowers the chance of sustainable excellent information in the housing market and raises the chance of a coming recession.

iBuyers pull again in this housing sector

While he is getting substantially extra selective in his acquisitions, Kearney has not stopped obtaining attributes completely, a system that some bigger institutional investors adopted in specific Tampa neighborhoods in late 2022. These neighborhoods are now experience the most pain in phrases of worth decline, in accordance to Kearney.

“The $500,000 dwelling is now $450,000. It is an interest rate calculation,” he explained. “Especially cookie cutter neighborhoods in which the iBuyers pulled out.”

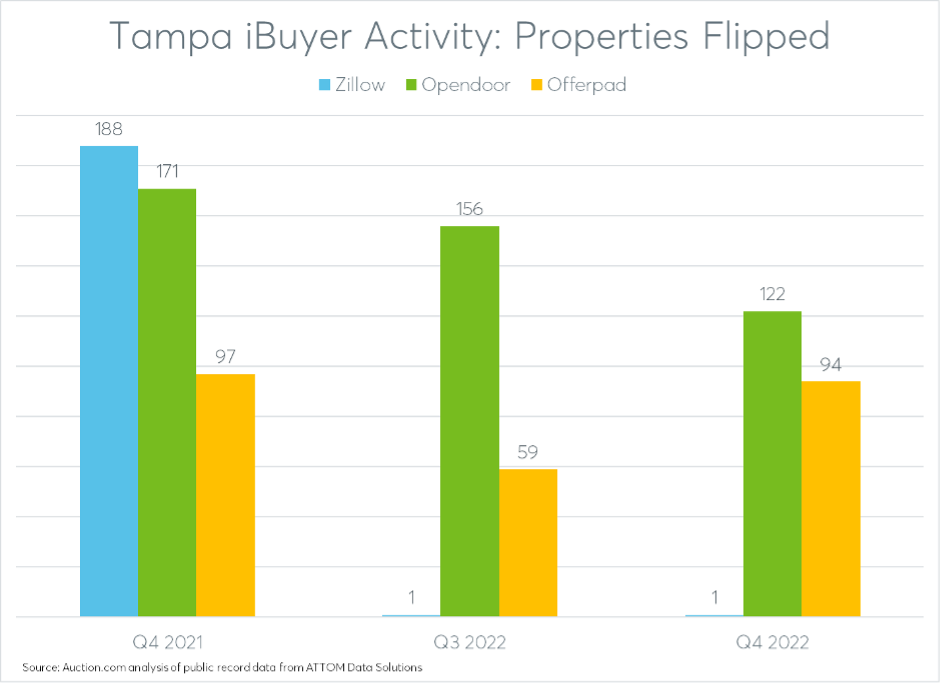

An Auction analysis of public report knowledge from ATTOM Details Methods shows iBuyer activity home flipping activity in the Tampa Bay metro spot dropping 52% in Q4 2022 as opposed to the calendar year just before. The fall was driven mainly by a 99% decrease in homes flipped by Zillow, but Opendoor dwelling flipping exercise was also down 29% around the exact time period and Offerpad property flipping exercise was down 3 %.

Opendoor misplaced an average of $6,000 on Q4 2022 flips, down from an ordinary achieve of practically $16,000 for each house for residences flipped in Q4 2021. Offerpad’s Q4 2022 flips still made an common gross achieve of virtually $12,000 per home (not including holding, rehab or promoting prices), but that was down 69% from the regular get of extra than $38,000 per property a yr right before. The one particular residence that Zillow flipped in Tampa in Q4 2022 sold for a whopping $173,000 considerably less than its acquire rate. In Q4 2021, Zillow’s 188 dwelling flips in the Tampa metro space averaged a gross obtain of about $7,000 for every residence.

Distressed house pricing tactics

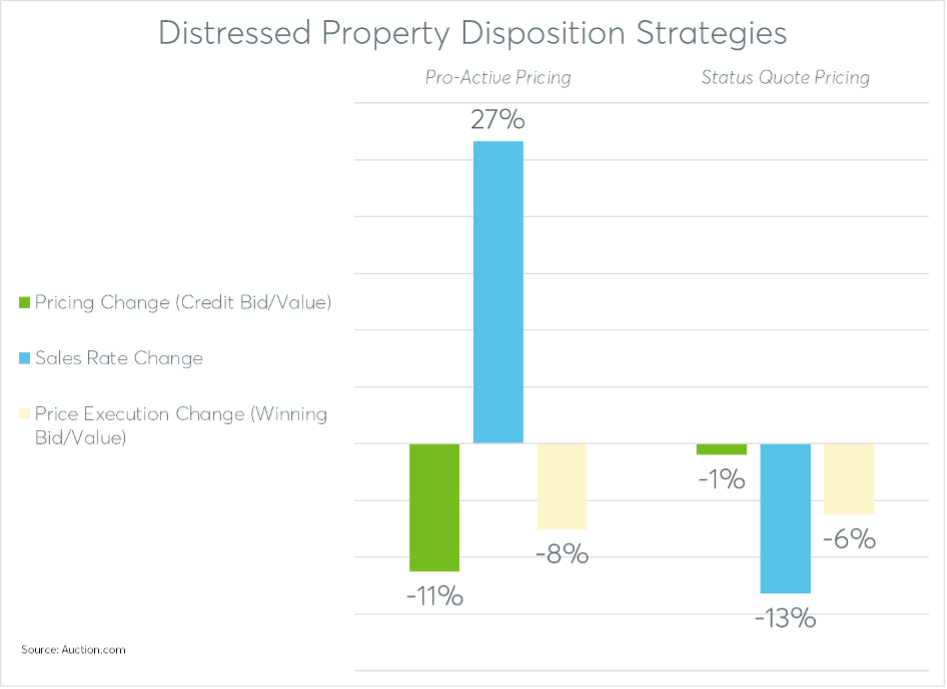

Facts from the Auction.com 2023 Distressed Current market Outlook report demonstrates how one more style of institutional vendor — lenders who are marketing at foreclosure or bank-owned auction — are modifying their disposition strategies in response to downshifting desire.

In the fourth quarter of 2022, the most proactive of these loan providers began altering their credit bids at foreclosure auction decrease, thereby retaining a sales rate of 50% or extra at the foreclosure auction. By maintaining that optimum foreclosure auction product sales level, these proactive lenders are in a position to lower disposition losses whilst also mitigating the hazard of keeping houses as genuine estate owned (REO) in a marketplace wherever household price ranges are flat or falling.

The fourth quarter adjustment by proactive loan providers decreased the regular price tag-to-price ratio for all foreclosures auctions on the Auction.com system by 3 percentage points, from 73% in the 3rd quarter to 70% in the fourth quarter. This was the in general regular, with the most proactive loan companies decreasing credit bids by much more than 5 factors.

People most proactive loan providers observed the sales price at foreclosure auction rise effectively over 50% by the conclusion of the yr whilst the gross sales rate for all loan providers continued to drop, albeit at a slower rate, bottoming out at shut to 45% in December.

Optimum disposition outcomes

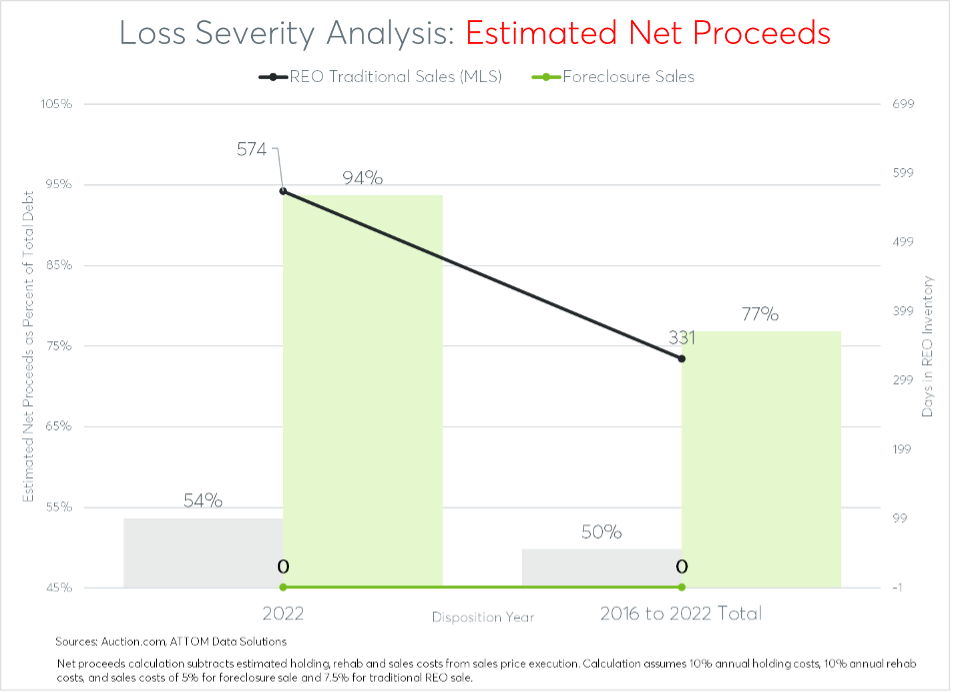

Keeping the foreclosures revenue amount higher than 50% allows distressed property sellers to ideal leverage the disposition channel that has been proven to generate the optimum web proceeds in a wide range of housing industry situations.

An investigation of far more than 435,000 distressed residence tendencies considering the fact that 2016 in the 2023 Distressed Marketplace Outlook report reveals that distressed qualities sold at foreclosures auction yield an approximated internet proceeds of 77% of the complete personal debt owed to the foreclosing lender. Which is 27 share points better than the approximated internet proceeds (50% of total personal debt) for qualities that reverted to REO and then were subsequently offered on the retail market place, normally by the Several Listing Support.

Holding properties as REO gets even much more dangerous in a slowing serious estate atmosphere. The performance hole amongst foreclosures sale tendencies and retail REO sale inclinations widened to 40 factors in the downshifting 2022 current market.

Exceptional community results

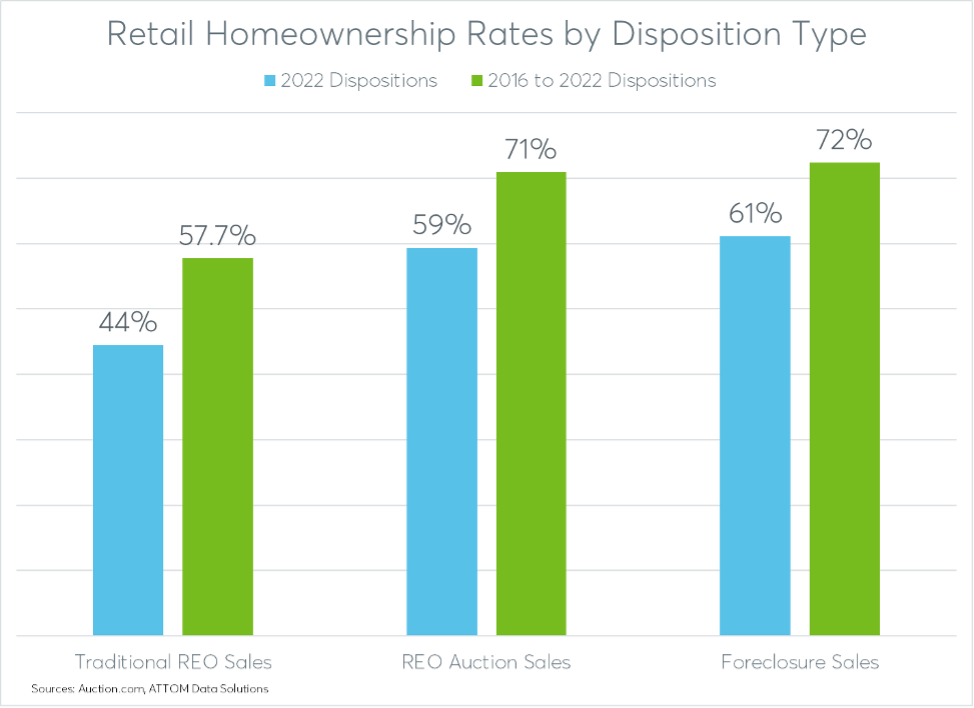

It also turns out that selling a lot more house at foreclosure auction lifts homeownership prices and increases home values. The similar assessment of 435,000 distressed house tendencies reveals that 72% of properties that ended up renovated and resold immediately after staying procured at foreclosure auction ended up in the arms of operator-occupants. That was 14 percentage factors bigger than the 58% homeownership charge for retail REO product sales.

The renovated foreclosure sale attributes ended up marketed for 99% of approximated “after-repair” value, indicating considerable renovation and supporting present favorable equivalent product sales for other homes in the encompassing neighborhood. By comparison, the retail REO revenue marketed for 73% of believed “after-repair” current market value.

Irrespective of promoting for close to entire “after-repair” market price, the renovated foreclosure qualities even now represented rather affordable housing, notably for family members in underserved neighborhoods.

Renovated foreclosures in lower-income Census tracts offered for an regular price of $211,963 in 2022, with the regular property finance loan payment on all those houses — which include home taxes, insurance and assuming a 5% down payment and the regular 30-calendar year fastened house loan charge in the month of the sale — requiring 22% of the regular monthly median income for families in the bordering tract. Renovated foreclosures in minority Census tracts marketed for an normal price tag of $223,227 in 2022, requiring 24% of the median spouse and children income in the bordering neighborhood.

To learn far more about pricing attributes in today’s industry, take a look at Auction.com.