India’s central financial institution has halted its ideas for a superior-profile undertaking supposed to rival the nation’s dominant payment system, Unified Payments Interface. The job had attracted sizeable interest from a assortment of big conglomerates, tech giants, and financial establishments, like Amazon, Reliance, Fb, Tata Team, Google, HDFC, and ICICI.

The Reserve Bank of India had in the beginning invited bids in 2021 for licenses to function new retail payment and settlement techniques throughout India. The venture was named New Umbrella Entity, or NUE.

However, according to RBI Deputy Governor T Rabi Sankar, the project’s probable participants failed to suggest “any modern or infrastructural answers.” Sankar emphasised the central bank’s interest in checking out concepts that go past incremental enhancements or substitutes for current systems.

UPI, which now procedures in excess of 8 billion transactions a thirty day period, was inching closer to the 1 billion milestone in 2021. The central lender sought to mitigate focus risk as UPI’s significance in the economic system continued to mature, aiming to acquire an alternate protocol that would ease strain on the existing program.

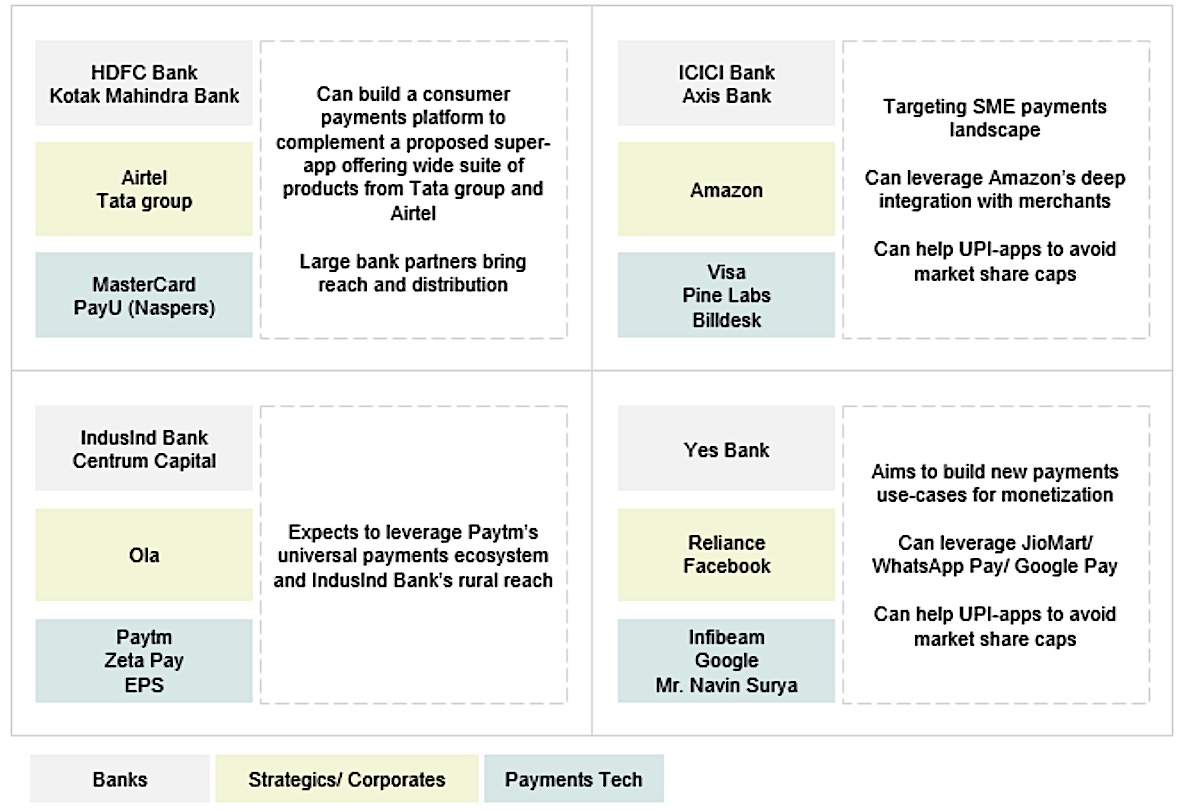

Sector players had shaped 4 consortia and have been scheduling to make a bid for the NUE license. Impression: Bernstein

PhonePe and Google Spend ended up commanding the most sector share in UPI in 2021 — not substantially has changed — and many sector members noticed NUE as a way to be early and intense with a new payments system.

In an previously proposal, RBI sought NUEs to be interoperable with every single other.

“Thus, NUEs do not have any proprietary access. Even so, NUEs can customize the networks to their organization design and distribution capabilities. If a conglomerate is robust in e-commerce, the NUE could customize to the particular desires of that use-scenario. UPI has market place share caps/calibrated growth for new players (eg. WhatsApp). NUEs would not have this kind of limitations and could help with accelerated community effects for non-public players. Hence, NUEs custom-made style and self-governance could offer much better capabilities. As opposed to UPI’s generic payment community, NUEs will have custom-made networks primarily based on use-conditions,” Bernstein wrote in a report in 2021.