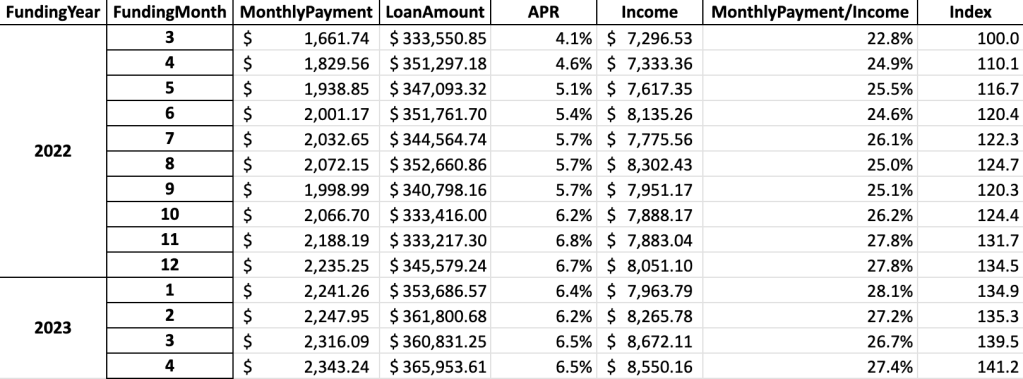

With mortgage loan charges however in the mid 6% vary, borrowers who gained home loans in April 2023 paid an ordinary of $2,343 a month, up 28% from a 12 months prior.

That’s in accordance to the latest origination details from home loan tech business Candor Engineering.

For each information from Candor’s underwriting motor, the average consumer in April 2023 obtained a mortgage value about $366,000 at an ordinary APR of 6.5%.

A calendar year in the past, the regular customer would have compensated $1,830 a month with a $351,297 mortgage at an desire fee of 4.6%.

The typical profits in April 2022 was $7,333 a month, according to Candor. In April 2023, the typical borrower’s earnings experienced shot up to $8,550 a month. However, the average monthly payment to money was 27.4% in April 2024, up from 24.9% a 12 months back.

“The current desire amount hike from the Federal Reserve proceeds to continue to keep the charge of home getting elevated when as opposed to the same period of time a single calendar year back,” reported Sara Knochel, CEO of data and analytics at Candor. “However, we are also viewing the homebuyer’s ordinary earnings on the rise as properly, which indicates additional Us residents may perhaps be buying up facet revenue sources in order to finance their household acquire.”

Look at out the previous 12 months down below: