Typical financial preparing and assessment groups expend the bulk of their time on data-accumulating and administering processes. Which is simply because they generally have to offer with cumbersome units and application equipment, leaving minor time to concentration on building insights that may well push enterprise advancement.

At minimum, which is according to Bijan Moallemi, the co-founder of Mosaic, a startup constructing a system that attempts to centralize operational information from throughout an organization. Mosaic these days declared that it elevated $26 million in a Sequence C funding round led by OMERS Ventures with participation from Founders Fund, General Catalyst, and Good friends and Loved ones Cash, bringing its total raised to $73 million.

Moallemi co-launched Mosaic with Joe Garafalo and Brian Campbell, who he satisfied in 2012 at Palantir, the huge knowledge analytics corporation, whilst supporting to create Palantir’s finance group.

“Tasked with supporting organization selections for a business — Palantir — in hypergrowth, we were being annoyed by the gradual velocity, substantial complexity and inefficiencies of present tools in the market,” Moallemi explained to TechCrunch in an electronic mail interview. “Realizing that the role of the CFO had developed in scope, but our toolkit experienced not, we set out to construct a system that would address the technological challenges modern day-working day finance and enterprise teams encounter.”

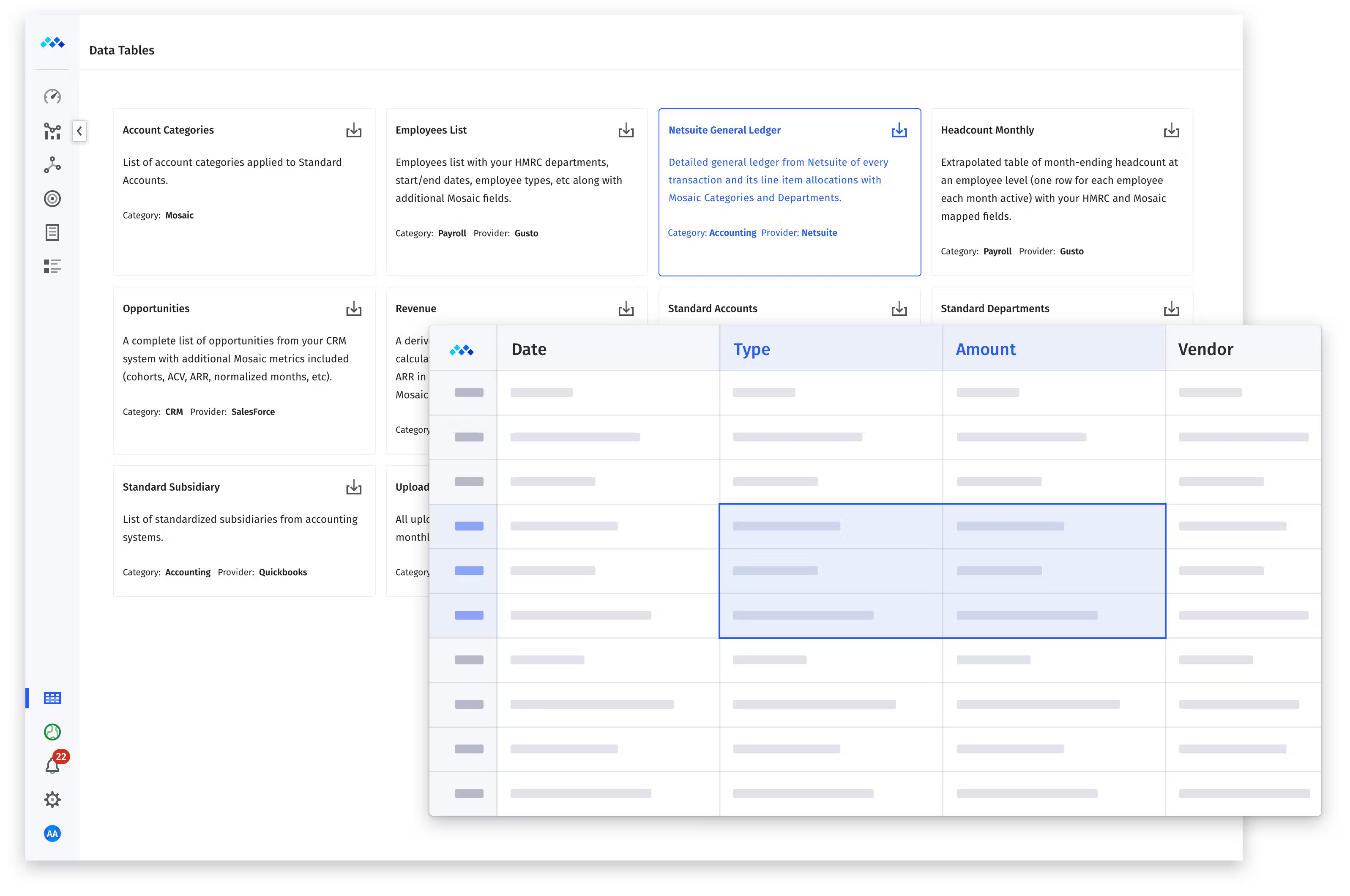

Moallemi describes Mosaic as a “real-time organizing and analytics” system. Stripping out all that advertising jargon, Mosaic presents dashboards, modeling and info visualization equipment geared towards monetary scheduling use instances, making it possible for people to swiftly share insights with stakeholders.

Image Credits: Mosaic

With Mosaic, providers can achieve a superior perception of when to execute on their strategies, Moallemi suggests, like when to broaden their product sales groups or raise a further round of funding. Buyers can make department or govt views for thanks diligence and go-to-market evaluation, giving a unified — but custom made-tailored — resource of real truth.

“In the past, implementing a legacy FP&A platform took months, bogging down the IT division with substantial need for engineering means,” Moallemi claimed. “We’ve architected Mosaic to do away with the require for IT means in implementation or upkeep … Instead of needing IT to respond to requests for knowledge, enterprise consumers can get authentic-time perception into the metrics that effect their every day pursuits.”

Mosaic, who counts Emerge, Sourcegraph and Drata among its buyers, claims company has “tripled” every single 12 months given that its founding in 2019 and that the burn off charge — the charge at which it is paying out revenue in excessive of earnings — is steadily reducing. Moallemi credits the pandemic with the progress, in component, as very well as the current general economic uncertainty.

There’s reality to what he suggests. According to a the latest study from Capterra, the majority (73%) of economic pros system to invest more on software program this year than they did in 2022. They stated taking care of a hybrid workplace, protection considerations and cyberattack risks as their top motivators.

“During the pandemic, the increase of remote perform developed a lot more need for collaborative workflows in finance,” Moallemi explained. “Macro slowdowns call for every person to do more with much less. And the remedy to that is employing engineering that increases the quantity of function men and women can do devoid of forcing the company to include headcount.”

In the in close proximity to term, Mosaic, which has 80 comprehensive-time workers, strategies to construct out the platform’s AI abilities and introduce resources together the strains of its a short while ago-released Metric Builder, which lets buyers build, assess and plan personalized monetary metrics. Added Moallemi: “We’ll go on to develop our scheduling and examination options while also generating AI a main part of the platform to empower this generation of agile, strategic finance leaders.”