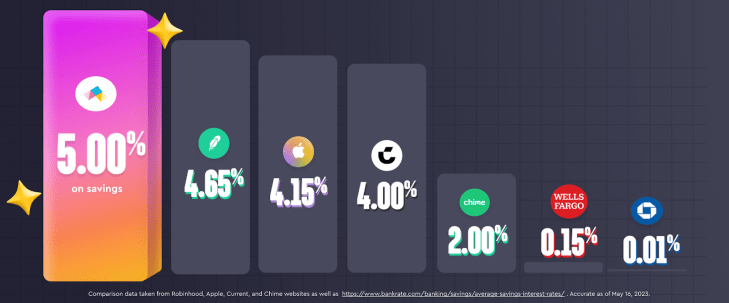

Stage, the digital banking services geared toward teens and youthful grown ups, is now giving a 5% rate on its savings accounts.

With just 1 in 3 Us residents getting satisfactory savings for emergencies, Move is amongst dozens of startups, like Latest, Greenlight, Super.com and Hyve, focused on encouraging men and women help save.

There are no month to month service fees and no minimum amount stability specifications on the Move accounts, and customers who open an FDIC-insured discounts account with up to $250,000. Even so, to safe that 5%, users have to set up a month-to-month immediate deposit of $500 or far more from a payroll service provider or employer.

“The immediate deposit is to persuade folks to use the complete suite of Step products,” CJ MacDonald, co-founder and CEO of Stage, advised TechCrunch.

And to be distinct, “the savings proportion is not curiosity, but as a substitute gained as money rewards right funded and managed by Phase,” according to the business.

Talking of rewards, also new is Step’s elevated rewards plan. Clients who qualify for the 5% on their price savings will also gain 3x details on purchases at choose merchants 2x details on cafe eating, food supply and charitable donations and 1x points on entertainment, streaming and gaming.

The news arrives about a thirty day period soon after Apple released its financial savings account harmony of 4.15%. When that announcement was manufactured, recent data from Bankrate confirmed cost savings accounts APY rate of 3.5% to 4.75%. As of Could 17, the APY range is 4% to 4.85%, so it’s harmless to believe that Apple’s entry into the industry perhaps impressed neobanks and other people monetary corporations to near the hole.

Action often had a goal to offer you the maximum percentage amongst rivals in buy to catch the attention of and mature with clients, so Apple’s go did not inspiration it to start the high financial savings charge, MacDonald claimed.

“The tough matter with interest rates is that they hold altering,” MacDonald explained. “In the very last 12 months and a 50 percent, prices have been likely up. Just about every time they go up, the [Federal Reserve] Fed Fund Rates go up, and for any establishment receiving compensated, the desire is likely up, also. If they keep on to rise, the 5% could go even larger. Primarily based on today’s fees, it’s vital to give shoppers back in essence what Fed Fund Fees are at.”

Stage is doing work with its extensive-time lender lover Evolve Financial institution & Believe in on the financial savings accounts. Meanwhile, the organization, which has elevated about $500 million in enterprise-backed funding — most a short while ago past Oct — has above 4 million account holders.