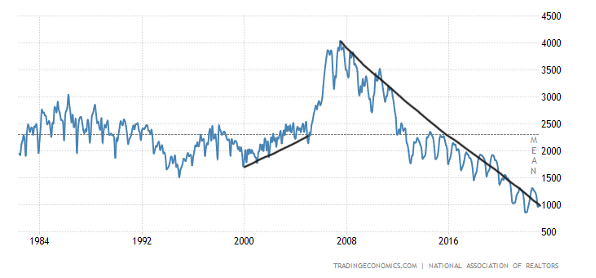

The chart under exhibits the number of energetic listings since 1982:

The persons who informed you demographics in the U.S. are dreadful and that we resemble Japan were consuming some powerful saki. For yrs, individuals stated slowing U.S. populace expansion signifies we will come to be Japan, but I’ve been targeted on demographics and how that will affect housing from 2020-2024. About the housing economics desire curve, it is usually about the net people living and functioning.

In reality, housing financial modeling usually takes a great deal of work, and some folks as a substitute opt for advertising gimmicks to make a name for by themselves. It’s really sexy to talk gloom and doom about the housing market, but occasionally that doesn’t conclude very well. I have been very skeptical of inventory traders when they speak about housing economics.

And here is a scenario in position: New house sales came in Tuesday at a large defeat of estimates, but the real story is 1 about source and demand.

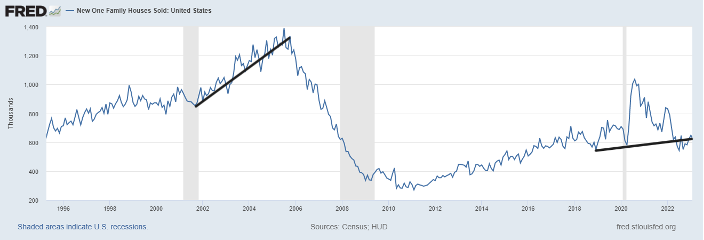

New house gross sales

From Census: New House Profits Income of new single‐family homes in March 2023 had been at a seasonally adjusted annual level of 683,000, according to estimates introduced jointly right now by the U.S. Census Bureau and the Office of Housing and Urban Enhancement. This is 9.6 % (±15.2 percent)* higher than the revised February rate of 623,000, but is 3.4 percent (±12.7 percent)* below the March 2022 estimate of 707,000.

As we can see in the chart below, it’s not like the new household income industry is booming at all we are not anyplace close to the top of profits in 2005 or in 2020. On the other hand, what has took place is that the housing data has stabilized.

When did this all materialize? The forward-on the lookout housing knowledge begun to enhance from Nov. 9, 2022, with obtain application knowledge, and almost anyone dismissed it. The thing is, builders have time to get the job done off their backlog of households mainly because they are economical sellers — they can slice price ranges, reduced mortgage loan costs and do what they need to have to do to offer their products, which is a commodity to them. They really don’t have the identical problems as an current homeowner since they’re not residing in the household they are promoting.

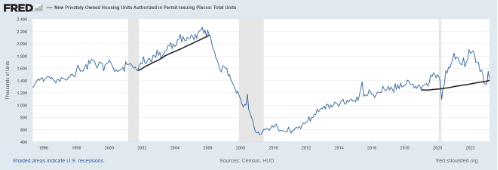

New Household Every month Supply

For Sale Stock and Months’ Provide, The seasonally‐adjusted estimate of new residences for sale at the close of March was 432,000. This signifies a offer of 7.6 months at the recent sales fee.

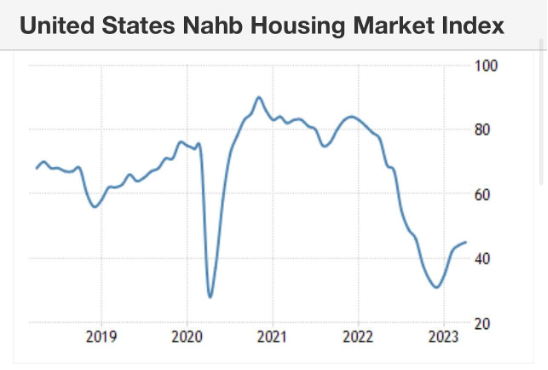

The builders are progressing in this article their confidence enhances as the month-to-month supply falls. Context is constantly critical with all housing details, and we experienced a waterfall dive in quite a few housing knowledge traces and bounced from that deep dive.

Having said that, the housing current market is still not great ample to start out issuing new housing permits. That’s when you will know housing is out of the economic downturn, and when the builders can start out creating all over again. It’s that basic.

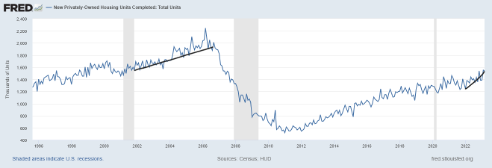

The details beneath is a major advancement for builders, as housing completions are still climbing when their regular source is falling.

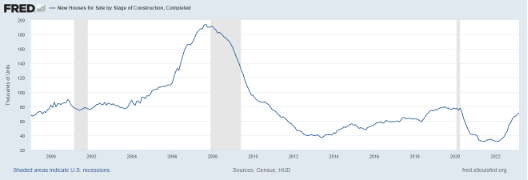

I have a simple model for when the homebuilders will begin issuing new permits with some kick and period. My rule of thumb for anticipating builder behavior is based on the three-thirty day period offer typical. This has nothing to do with the existing dwelling profits industry — this monthly provide info only applies to the new dwelling profits current market, and the existing 7.6 months are much too substantial for the builders to difficulty new permits with any normal steam.

- When supply is 4.3 months and beneath, this is an exceptional sector for builders.

- When offer is 4.4 to 6.4 months, this is an Alright builder sector. They will make as very long as new residence sales are growing.

- When the provide is 6.5 months and higher than, the builders will pull back again on development.

So, as we can see under, the homebuilders are no for a longer period working with spiking source data but a gradual-going downtrend that nevertheless requirements a great deal function. Having said that, there is a great deal far more to this the active listing tale than fulfills the eye.

The 7.6 months of offer is broken down this way.

- 267,000 properties are underneath design, even now. 4.7 months of offer

- 94,000 homes still have to have to start building. 1.7 months of supply

- 71,000 homes are finished for sale. 1.2 months of supply

No, I am not kidding you the mass provide increase some people have been conversing about is only 71,000. We are considerably from the peak of supply throughout the housing bubble crash nears, which was closer to 200,000.

All in all, Tuesday’s new household income report is steady with what we have observed in the new property product sales facts for many months now. The builders are simply taking benefit of the reduced full housing inventory by executing what ever it takes to go their solution, and that is staying assisted by paying out down the mortgage level for their potential buyers. Consider what the full housing market would search like if home finance loan rates ended up at 5% now.

As aspect of the Housing Sector Tracker, we appear at seasonal inventory weekly, and with any luck ,, the seasonal inventory base has by now occurred, as I speak about listed here.

Concerning Wall Street’s just take on the surprise in the new household product sales sector, was it truly a shock? Someone had to be obtaining the builder shares, proper? The fact is that home profits crashed past yr and that didn’t make the inventory that some housing professionals ended up wanting for previous yr and this yr. This is in which being familiar with how credit score channels effect housing inventory would have assisted.

Hopefully, my do the job for the duration of my time as a housing analyst for HousingWire has introduced some gentle into this discussion, and this will be additional in focus when the future recession hits. On the other hand, until finally then, the Housing Industry Tracker details obtained ahead of this stabilization in new property revenue facts, and that shouldn’t have shocked Wall Street.