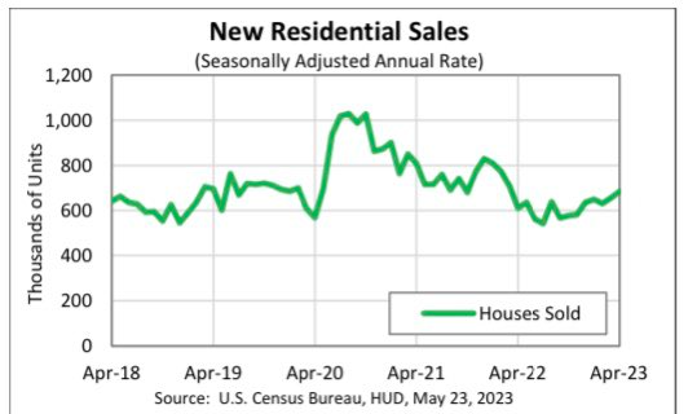

The new house profits report has been the similar tale for just about 18 months, with property income stabilizing from a reduced level.

From Census: New dwelling income: Profits of new single‐family properties in April 2023 were being at a seasonally adjusted annual charge of 683,000, in accordance to estimates released jointly nowadays by the U.S. Census Bureau and the Office of Housing and Urban Improvement. This is 4.1 p.c (±11.8 percent)* higher than the revised March charge of 656,000 and is 11.8 percent (±15.1 percent)* earlier mentioned the April 2022 estimate of 611,000.

Previous calendar year, although the Census Bureau was reporting the new residence gross sales numbers and the builders were getting substantial cancellation costs, the regular monthly gross sales report did not account for the cancellations of contracts. This can make the monthly reports larger than ordinary, so using that into thought, the new house sales figures ended up definitely low last yr.

Past year, sale amounts were meager and when home finance loan charges fell and the builders had been acquiring down costs to get far more households bought, the data stabilized and moved bigger slowly. To give you an strategy of the percentage of houses the place the builders were being offering a purchase-down, the main economist of the Nationwide Affiliation of Property Builders, Robert Dietz, tweeted out this details line on Tuesday: “21 pct of builders utilized home finance loan price purchase downs in April. It was 33 pct very last Fall. Extra very likely big builders.”

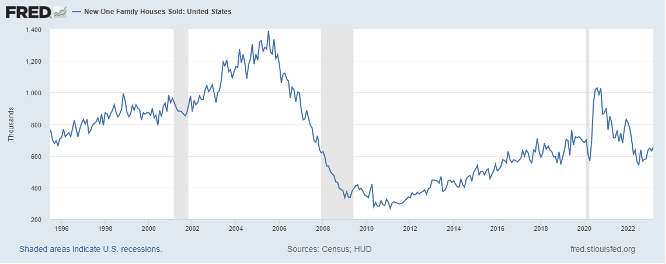

Wanting at new property income with an historic context, you can see that we weren’t doing work from a superior bar last year on gross sales. So, the bar was pretty low to just have need stabilize as rates fell, substantially like the present property income market. We also have a whole lot more staff now than what we did again in 1996 — the stage where new house revenue have been trending last year.

Just like with the present property profits sector, all that is happening is that home sales stabilized from a reduced level.

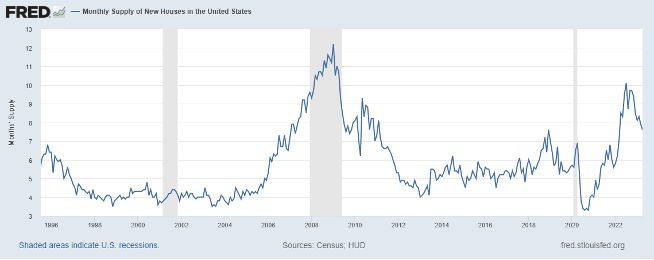

This is unique from the 2007 housing current market when the builders’ gross sales ended up nevertheless collapsing and month-to-month supply spiked with rising cancellation prices. The reverse is going on now cancellation charges have been slipping from a substantial amount and monthly supply is slipping.

I have a clear-cut model for when the homebuilders will start issuing new permits with some kick and period. My rule of thumb for anticipating builder conduct is dependent on the 3-month offer typical. This has very little to do with the present house revenue current market — this regular source knowledge only applies to the new house gross sales sector, and the current 7.6 months are as well higher for the builders to difficulty new permits with any pure steam.

- When supply is 4.3 months and down below, this is an great market for builders.

- When source is 4.4-6.4 months, this is just an Alright sector for builders. They will make as very long as new household sales are developing.

- When supply is 6.5 months and earlier mentioned, the builders will pull back on development.

From Census: For Sale Stock and Months’ Offer: The seasonally modified estimate of new residences for sale at the conclusion of April was 433,000. This signifies a provide of 7.6 months at the present profits amount.

When we speak about the monthly source facts, we need to have to split it into subcategories simply because the 7.6 months has bewildered many folks.

- The Stock for properties done is at 70,000 = 1.23 months of offer.

- The Stock for properties beneath building is 263,000 = 4.6 months.

- The Stock for properties that haven’t began nonetheless is at 100,000 = 1.8 months

As you can see, we really don’t have a good deal of new properties all set to go — we have an abnormally significant amount of new homes nevertheless in design and the builders don’t just ramp up creation right until they know they can market these properties for a financial gain. I am skeptical of any major select-up in housing permits until finally we exceed 6.5 months of provide and new house profits rise.

So, if you’re puzzled about housing however remaining in a recession though had been intended to have been in a bubble crash previous year — only to see the builders performing Ok with the details previously mentioned, I really do not blame you. Usually, with a housing bubble crash, you don’t have new house product sales stabilizing, cancellation fees slipping, regular monthly provide slipping and increasing builders’ self esteem. These financial facts traces really don’t occur when we are in a housing bubble crash 12 months.

The actual story is that lively listings are nevertheless very small historically, the builders had and however have a sizeable backlog of homes to end and get marketed, and they are working by way of that backlog. They can do this by cutting selling prices and obtaining down rates, as I think they are economical sellers.

Now that mortgage loan prices have strike 7%, the dilemma is irrespective of whether the builders can go on to hold this slow uptrend in profits heading. The housing market has not responded very well with 7% as well as mortgage costs and this is now the 3rd time this has transpired because the big operate-up in mortgage charges in 2022.