Following the latest extraordinary present of power defending changes to LLPAs by federal regulators and their good friends, the forest through the trees chance stays in target to me.

Just one of the good worries I have, as each a former regulator and the former head of a main business trade association, is the draw back danger of holding the GSEs in conservatorship any more time. For me, it is really a problem about the lesser of two evils.

What is the better threat to housing: an infinite series of FHFA administrators who improve seats with each individual political administration and then continue to tinker with coverage in pursuit of political priorities? Or, the danger of releasing Fannie and Freddie devoid of firmly legislating some of the reforms that I and several others advocated for, going again to the early a long time of conservatorship?

Make no slip-up about it, I sat firmly entrenched for a long time opposing the “recap and release” group, to the point where by the camps on the two sides of the concern have been in nearly pitched warfare. The Mortgage loan Bankers Affiliation argued that Congressional reform should really precede any effort to launch the GSEs. In point I testified in front of Congress in 2017 stating this kind of.

But nowadays I now see the challenges of letting this drag on into perpetuity with no take care of. As every succeeding FHFA director comes into the purpose the business, possible owners, loan companies and more will encounter the risk of a cascading series of coverage initiatives currently being applied by the GSEs at the behest of the FHFA, irrespective of whatsoever protests that may well occur from the respective staffs at both GSE.

Although the most current was this obviously manipulated LLPA pricing composition and the now unsuccessful try at a DTI cap, the list of charges additional to 2-4 unit homes, second properties, hard cash-out refinances, and far more show up to be concentrated on political goals and not precise hazard.

In actuality, MBA typically argued that g-charges and other pricing methods at the GSEs really should only replicate the real risks of the financial loans and not be employed for other uses. Prior to the collapse of Fannie and Freddie, pre 2008, the GSEs would give most popular pricing to their premier sellers in what was recognized as “alliance” agreements. The distribute in pricing in between a big vendor and a small 1 was important.

I try to remember early in my career at MBA having 3 CEOs of independent home finance loan banking companies to meet with then Acting FHFA Director Ed DeMarco to argue in opposition to any rate disparity based on something but the precise hazard of the bank loan. And DeMarco responded, nearly completely eradicating the pricing variances through his tenure.

But currently we have additional to be anxious with. You see, the LLPA improvements, though modest in effect, were being just part of the slippery slope of adjusting expenses and policies to make the GSEs do enterprise differently and to get them to emphasis additional on entry-level homebuyers.

The City Institute places out a month-to-month chart e book that is chock-total of extraordinary data about our market. In the most modern Could release, they exhibit just how tricky it is for the GSEs to develop accessibility to minorities who make up a considerable share of new very first-time homebuyers.

As the chart above demonstrates, it’s the Ginnie Mae packages, FHA in particular, that entirely dwarf the attempts of the GSEs in this regard. And though these modest adjustments to LLPAs could possibly assistance, there is much more that impedes the potential of the GSEs to be helpful in this location.

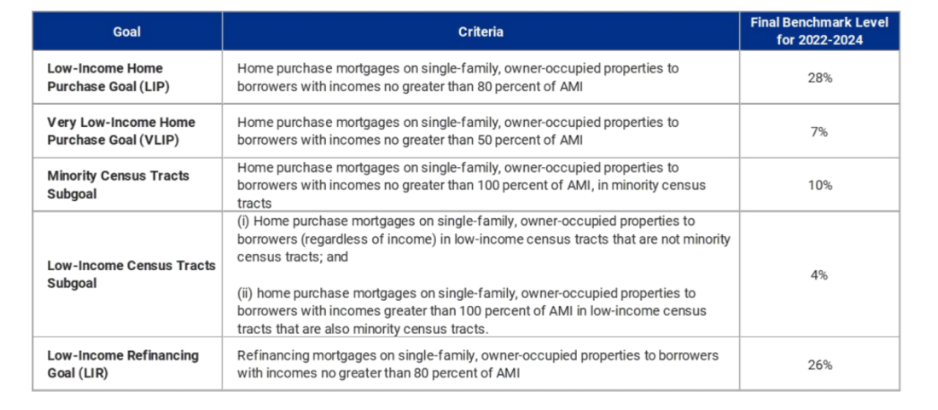

But FHFA has not stopped there. There is the implementation of objectives concentrated on LIP (reduced profits order loans) and VLIP (extremely very low income purchase financial loans) that could final result in a variety of unintentional distortions to pricing and credit score availability. It’s all in their affordability objectives and, when complicated, we can already see distortions.

The goals, proven in the chart earlier mentioned, are very clear, but if you search at how the GSEs have done historically against these figures, the point is that there are a lot of yrs in excess of the previous 10 years the place these plans would have been skipped.

But now points are transforming. The GSEs are making use of the funds window to purchase extra of these LIP and VLIP financial loans, decreasing the effectiveness of the dollars window for other needs. We are viewing the GSEs start out to selectively decrease the quantity of superior-stability buys in get to improve the percentages.

About the training course of 2022, it seems that Freddie may possibly have begun giving selected prospects pricing incentives for decrease equilibrium owner-occupied buy financial loans and also authorized customers with increased numbers of these loans to improve their shipping percentages.

Fannie Mae, on the other hand, would seem to have needed shoppers to just provide a agent combine of VLIP and LIP loans to both of those GSEs. Considering the fact that Fannie Mae had lessen supply percentages with selected buyers that experienced far more of the reduced stability financial loans, they imagine they did not fulfill some of the organization housing aims for 2022.

The require to hit the targets is forcing the GSEs to cut down the potential of sellers to supply what the current market will bear and rather provide to the blend the targets that they require. The trouble right here is that they are turning to adverse incentives.

Experiencing a sector that is not making loans at the aspirational degrees of the recent VLIP and LIP goals, the GSEs show up to have turned a corner. They are transitioning from good incentives that might encourage better production of housing objectives loans, to now imposing disincentives, from equally a pricing and quantity point of view, that build an adverse impression on a important vast majority of GSE proprietor-occupied acquire debtors.

Reported in a different way, the GSEs are not able to deliver enough VLIP and LIP “numerator” loans, so they have no substitute but to try to lower the non-VLIP and LIP “denominator” loans in an hard work to realize the ratios that FHFA proven.

Glance, the GSEs have constantly experienced inexpensive housing goals. What has modified is that they no extended have a retained portfolio that can be utilised to aid meet these objectives via bulk purchases. But much more importantly, this new construction is forcing pricing distortions which we are by now looking at blatantly although the LLPA structure, but even additional so via modifications to use of the funds window, disincentives to sellers to reduce bigger balance financial loans, and a lot more.

All of this will lead to hurting the mainstream debtors that the GSEs have constantly served.

As shown above in the chart showing the GSEs’ blend to other resources, most likely we will need to assume in another way here. Of course, realistic targets make feeling for the GSEs. But all the courses in Ginnie Mae nonetheless dwarf any capacity the GSEs have to significantly change the current market.

But the greater problem we all need to have to inquire is this: is the lesser of evils the have to have to release the GSEs from conservatorship and let them to return to a additional self-managed business atmosphere? This would reduce the capacity of their regulator to use these two corporations for political functions, which may possibly distort the sector in ways that are in the end additional harmful than any gains they may make alongside the way.

For me, I have turned this corner. The GSEs are considerably way too important to be overly manipulated in techniques that may damage execution for the traditional homebuyer in these applications. There are other means to explicitly support inexpensive housing targets. This to me is just too slippery a slope.

As I see the forest through the trees, I am faced with a new conclusion. We need to have to launch the GSEs from conservatorship as quickly as probable. There is far too much at chance to the housing finance process over time as we erode their main small business styles for political needs.