A short while ago, the director of the Federal Housing Finance Agency (FHFA) issued a assertion clarifying the agency’s rationale for improvements to personal loan degree pricing adjustment (LLPA) expenses going into outcome on May perhaps 1. The variations have created some controversy due to the truth that improved credit score high-quality borrowers will expertise bigger expenses following May well 1 than beneath the present-day LLPA grids and vice versa for reduced credit score high-quality debtors.

The FHFA stated that the ambitions of the price variations have been “to maintain assist for obtain borrowers restricted by profits or prosperity, make certain a amount enjoying industry for large and tiny creditors, foster cash accumulation at the Enterprises, and achieve commercially viable returns on money over time.”

Therein lies some of the confusion. The truth is that the FHFA is implementing a sort of chance-primarily based pricing to the workout based on their expectations of extensive-term performance of mortgages likely ahead. On the other hand, the new LLPAs mirror a method that lowers the effects of hazard-dependent pricing based mostly on other objectives, the outcome of which will advantage high-danger borrowers at the expenditure of reduced-danger borrowers by flattening the romance of credit history hazard to credit history rating and LTV.

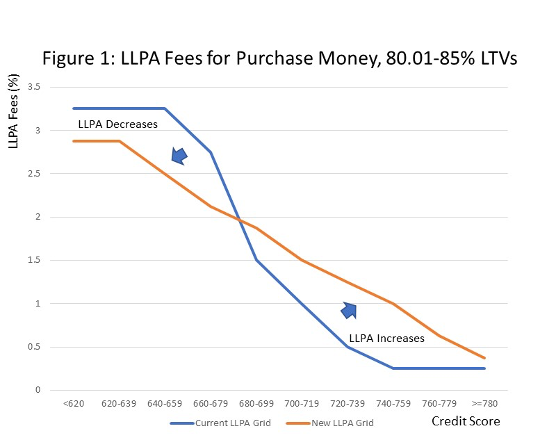

To achieve a visible perception of how the expenses will change, consider Figures 1 and 2 beneath that show the real LLPAs for two critical borrower segments 75.01-80% LTVs (no house loan insurance coverage needed) and 80.01-85% LTVs (with mortgage loan insurance plan) by credit history score. In both equally scenarios the existing and new LLPA grids show what we should expect typically if financial loans are chance-dependent priced, i.e., costs boost as credit rating scores decrease.

Nevertheless, observe that the new LLPA curve is considerably flatter than the existing LLPA curve for both of those LTV groups. A flattening of the curve suggests that there is a lot less differentiation in costs throughout credit score score categories keeping LTV constant. In the extreme, with out risk-dependent pricing, the curve would be horizontal across credit score scores, i.e., no differentiation in charges.

In other words and phrases, the new grids have become fewer hazard-primarily based, and that has implications for substantial- and lower-threat borrowers. By flattening the curves and pivoting all around the 680-699 credit rating score bucket, large-hazard borrowers acquire, and lower-hazard borrowers reduce from these improvements. What lies driving the curve flattening looks to be the FHFA’s perspective on the extensive-time period efficiency of mortgages.

The new expenses are set these types of that, specified threat-centered capital specifications of the GSEs in general, they would make sure the enterprises accomplish a concentrate on fee of return. Structuring the LLPAs with this approach even now presents the FHFA some latitude to set costs throughout danger attribute mixtures that can accomplish other aims these types of as supporting small-cash flow borrowers.

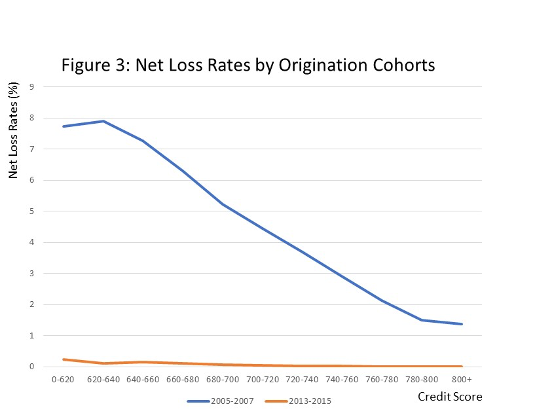

As the FHFA pointed out, the recent grids were being produced some time back and may well mirror home finance loan effectiveness from a much less benign financial natural environment than now. If so, the latest curves would tend to be steeper if this had been the case. To recognize how this might happen, take into account Determine 3 beneath, which depicts real web loss charges for home loans procured by Fannie Mae for two various sets of vintages a extra serious time period represented by origination a long time 2005-2007, and 2013-2015 representing a significantly a lot more favorable time period of time.

It is apparent from Figure 3 that although net reduction fees have been significantly bigger for the 2005-2007 vintages than 2013-2015 originations, the web reduction charge curve is flatter for the 2013-2015 cohort. Although working with these two vintages represents effectiveness extremes, it illustrates that in redesigning LLPA grids to greater reflect prolonged-phrase mortgage overall performance, the FHFA could be tilting the fee composition a lot more to mirror a flatter partnership of credit rating efficiency and threat attributes than in advance of.

Credit history general performance distinctions by credit score rating are far more apparent all through the far more demanding period than during the much more favorable financial conditions skilled by the 2013-2015 vintages.

What does this all indicate?

To start with, the FHFA is technically implementing concepts of threat-primarily based pricing but has obviously dampened the outcome based mostly on coverage targets past individuals of making sure the basic safety and soundness of the GSEs. The flattening of the LLPA curves suggests that while the FHFA is working with a danger-adjusted return on regulatory capital approach to established LLPAs, there was some latitude in location particular person expenses that would aid guidance lower-income borrowers so very long as holistically they met target returns.

2nd, the alterations will differentially influence borrowers as explained previously mentioned.

Developing the LLPAs in a method that obtain many goals can be a tough enterprise with no distinct appropriate or mistaken solutions, but maybe the FHFA thinks it can have its cake and consume it also by structuring the grids in these a way that it can tout conference all of its targets.

But transforming grids at a time when there are cracks in the economy might not be in the best curiosity of the enterprises. While it is technically genuine that the FHFA is making use of threat-dependent pricing to the new LLPA grids, it has proficiently diluted its influence and in the course of action done so at the reward of significant-possibility debtors to the detriment of higher credit quality debtors and exposes the GSEs to better chance really should a downturn in the economic system unfold than if the present LLPAs have been left in position.

Clifford Rossi is Professor-of-the Exercise and Government-in-Residence at the Robert H. Smith School of Business at the College of Maryland. He has 23 many years of marketplace knowledge having held various C-degree govt risk management roles at some of the most significant fiscal establishments.

This column does not essentially replicate the impression of HousingWire’s editorial division and its entrepreneurs.

To make contact with the writer of this story:

Clifford Rossi at [email protected]

To speak to the editor liable for this story:

Sarah Wheeler at [email protected]