Credit obtaining tighter

What we ordinarily see likely into economic downturn and in the course of a downturn is credit history acquiring tighter. What does tighter credit history indicate for housing? It implies certain property finance loan merchandise may not be made available, FICO score demands could be raised, and it can necessarily mean pricing for specific financial loans goes up to account for the possibility.

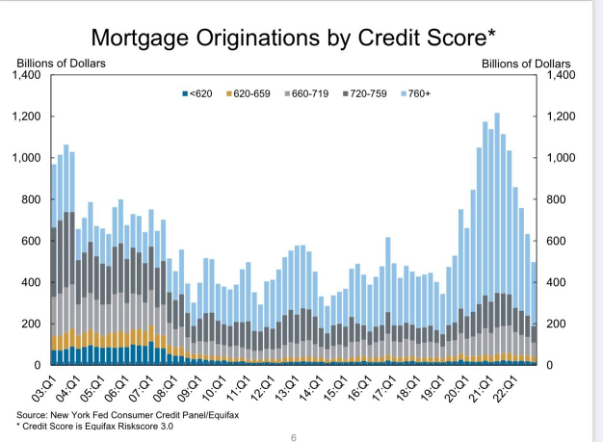

Even so, the latest housing sector is substantially various than the credit score increase-and-bust cycle of 2002-2008, and it is critical to have an understanding of why.

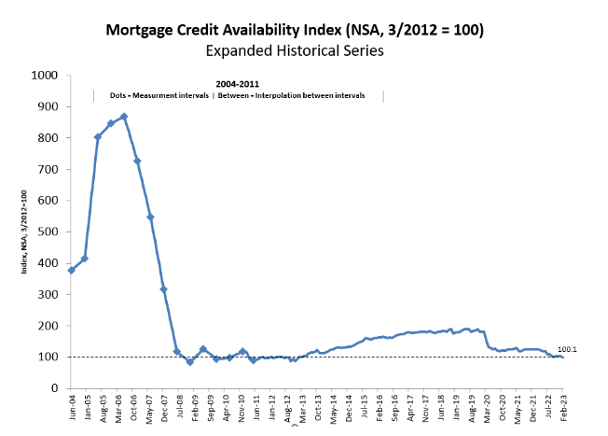

Credit availability was booming through the housing bubble many years, then collapsed epically. The MBA chart under demonstrates what a extensive collapse it was then. Now, with new restrictions in put given that the financial disaster, that credit history enlargement and collapse will be a as soon as-in-a-life span function.

Why is this so vital? About the years, a person of my massive conversing points has been that we didn’t have a massive credit history housing growth in the U.S. during the very last couple of several years, nor can we ever. Simply because of the qualified home finance loan legislation of 2010, we are lending to the potential to individual the financial debt, which implies speculative credit history cycles from main resident homebuyers or even traders just cannot occur in the exact fashion as from 2002-2005.

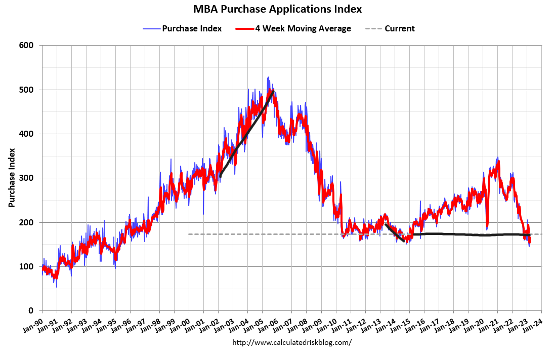

The buy application information down below clearly demonstrates this. We experienced many a long time of a great deal higher credit advancement during the bubble a long time and not that considerably credit rating in the earlier few yrs.

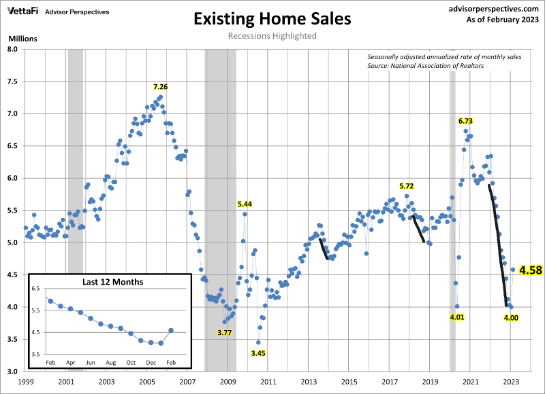

This is significant because the existing residence revenue market was booming through the 2005 peak that market wanted credit score to continue to be loose to continue to keep demand superior and developing. That is not the case currently. We experienced a large collapse in need in 2022, not since credit score was obtaining tighter but mainly because affordability was an issue.

Just after costs fell a short while ago, doing work from a shallow degree, we noticed one particular of the most sizeable month-to-month sales prints in record with the previous existing house sales report.

This large bounce in desire came from a waterfall dive, and we needed at least 12 months of good, forward-searching details to get this demand increase, but it happened as property finance loan premiums fell. Home finance loan credit rating can get restricted for jumbo financial loans, non-QM loans and household equity traces, but normal conforming Freddie Mac and Fannie Mae financial loans, FHA, and VA financial loans ought to be continuous for the duration of the upcoming economic downturn.

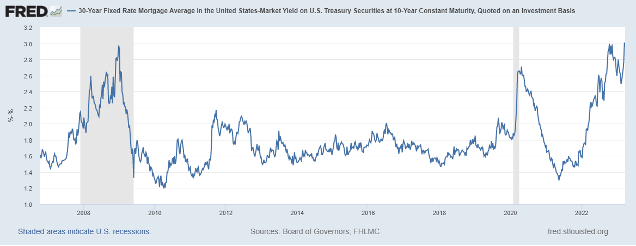

Spreads are obtaining vast once again

What has occurred not too long ago with the banking crisis is that the home loan-backed securities industry has gotten additional pressured, so prices are greater than they should really be as the spreads concerning the 10-12 months yield and property finance loan fees have widened once again.

As you can see below, the spreads acquired substantially broader through the excellent economic crisis and COVID-19 recessionary durations. There is normally a 1.60%- 1.80% variance amongst the 10-12 months yield and 30-yr property finance loan price, but now we are at 3%.

The chart beneath tracks the tension in the home loan-backed securities market place: the bigger the spread concerning the 10-12 months generate and 30-12 months house loan gets, the bigger the line goes. This suggests the dance partners, even though nonetheless dancing, are developing some house between each other.

The Federal Reserve does not treatment about the U.S. housing sector. The Fed is complaining mortgage prices are returning to 6% and persons getting properties could possibly make their job more difficult. The Fed will hurry to conserve a financial institution, but won’t whisper a word for an overall housing market to improve spreads.

So, the danger here is that when we have a occupation-reduction recession, spreads get even worse, as the Federal Reserve does not care. I would commonly think the Fed might assist the financial state, but with this Federal Reserve, you hardly ever know what they will and won’t do. I talked about this Wednesday on CNBC.

We have to have to be aware of this when the recession hits. The housing market could possibly not get any help, even although we are finding closer to the one particular-year phone when I set the housing market in a recession on June 16, 2022.

Home-owner equilibrium sheets seem magnificent this time all over

As I stated above, credit having tighter in connection to need is not a matter mainly because we did not have a substantial credit score growth like that from 2002-2005 to then have a bust from 2005-2008 due to credit history having tighter.

The mortgage loan sector can get stressed since the spreads can get wider, this means premiums can be higher than at regular situations. Nonetheless, we aren’t going to see the credit history availability collapse in the similar way we did in 2008.

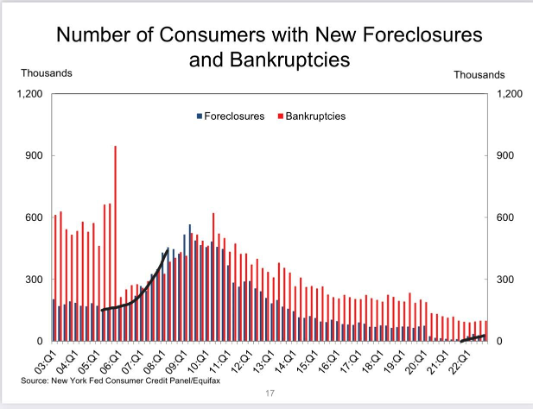

The most major big difference involving 2008 and the last 13 a long time right after the capable mortgage loan rules were applied is that we don’t see a surge in housing credit rating pressure before a work-loss recession. If there is 1 chart I would present each and every working day, it is the one beneath: housing credit rating strain was easy to place yrs before the position-reduction economic downturn happened. Now it’s considerably easier to see that we never have similar credit rating strain with homeowners.

Mainly because the U.S. has no a lot more unique loan debt constructions, we do not have massive-scale hazard tied to householders and banking companies. In excess of time, the foreclosure data ought to get nearer to pre-COVID-19 ranges, but almost nothing like the credit stress we saw from 2003-2008.

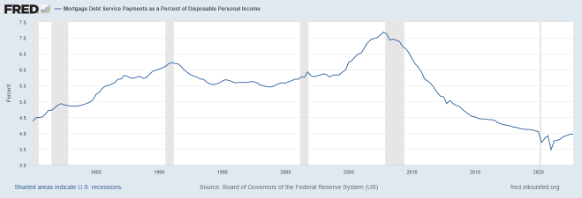

Homeowner monetary facts appears to be amazing set debt price tag, rising wages, and cash circulation seem much better and much better about time. As you can see down below, home finance loan debt services payments as a % of disposable personal profits look superb, much greater than in 2008.

This usually means the income flow appears to be like superb! Do you want to know why individuals are not offering up households? A U.S. residence with a 30-12 months preset property finance loan is the best hedge on planet earth. As inflation will come down, homeowners’ money move gets much better. During inflationary periods, your wages increase more rapidly, but as a home-owner, your personal debt expenditures remain the very same.

In contrast to 2008, we do not have a big hazard of loans recasting with payments that the home-owner can not find the money for even if they ended up nonetheless doing the job. We will see a rise in 30-working day delinquencies, and around 9-12 months, we will see a foreclosure method do the job. Nonetheless, in terms of scale, almost nothing like what we noticed in 2008.

Ideally, this offers you a few distinctive credit rating will take on the credit score question when we go into economic downturn.

Credit tightening regarding most financial loans staying performed right now is not a significant risk simply because governing administration businesses again most loans finished in the U.S. Nevertheless, the mortgage-backed securities sector can remain stressed for a longer time than most folks envision when the future recession transpires.

We don’t have a increase in foreclosures as we did from 2005-2008 right before the occupation-decline economic downturn. Nonetheless, we do have common chance, indicating that late-cycle homebuyers with tiny down payments can be a future foreclosures chance if they eliminate their careers.

So, we have a various financial backdrop now than in 2008 and 2020. The two recessions ended up pretty distinctive from just about every other, but this presents you an concept of some of the important dynamics all over housing credit score, credit card debt and risk whenever we go into the subsequent recession.

As generally, we will acquire the facts a person working day, 7 days, and thirty day period at a time and wander this path together.